The arrival of DeepSeek on the market has profoundly shaken the Western technological and financial sector, generating significant losses for US stocks such as Nvidia, Alphabet, Microsoft, and Meta.

The Chinese artificial intelligence model has triggered a wave of deep uncertainty among investors, who now question the sovereignty of the United States in the world of chips.

How will this event affect the future of Nvidia and what will be the consequences on the crypto AI niche?

Let’s see all the details in this article.

The advent of DeepSeek shakes the US tech markets: Nvidia, Alphabet, Microsoft, and Meta stocks in deep red

Yesterday, the entire US stock market crashed downwards after the Chinese AI model DeepSeek went viral worldwide.

Leading technology companies in the USA such as Nvidia, Alphabet, Microsoft, and Meta have recorded significant losses already in pre-market, following the release of this successful application.

More specifically, what seems to have caused turbulence in the American stock markets was the debut of the DeepSeek-R1 chatbot (similar to ChatGPT).

This product has gained notoriety in record time, bringing the DeepSeek mobile app to the #1 ranking in the list of the most downloaded apps on Apple’s App Store.

The most shocking thing is that this artificial intelligence model was created in just 2 months, with only 10 million dollars in funding.

In comparison, OpenAI has invested billions of dollars in years of research and development to create a solution similar to the Chinese competitor.

Furthermore, it seems that DeepSeek requires 95% less GPU computing power compared to other competitors, offering the same type of result.

Let us get this straight:

DeepSeek was built in UNDER 2 months for less than $10 million and it’s now #1 on the App Store.

On top of this, it was built with outdated chips and small team of <200 people.

Meanwhile, the US is pouring $500 BILLION into AI.

How is the Nasdaq not… pic.twitter.com/3cYiDC0cUC

— The Kobeissi Letter (@KobeissiLetter) January 26, 2025

The technological competition between the United States and China, already intensified in recent years, has reached a new level of complexity with the introduction of DeepSeek.

Investors have liquidated large positions from Western tech stocks, frightened by how the Chinese novelty could have challenged the USA dominance.

In particular, Nvidia stocks were the most affected by the situation, considering the negative implications on the sales of their video cards.

The Chinese AI model, requiring less computational power, effectively threatens Nvidia’s GPU market and their sales.

This climate of uncertainty has had a strongly negative impact on the entire universe of Wall Street, with the index Nasdaq 100 E-MINI dropping by 3% yesterday.

Today, the USA markets seem to be in slight recovery.

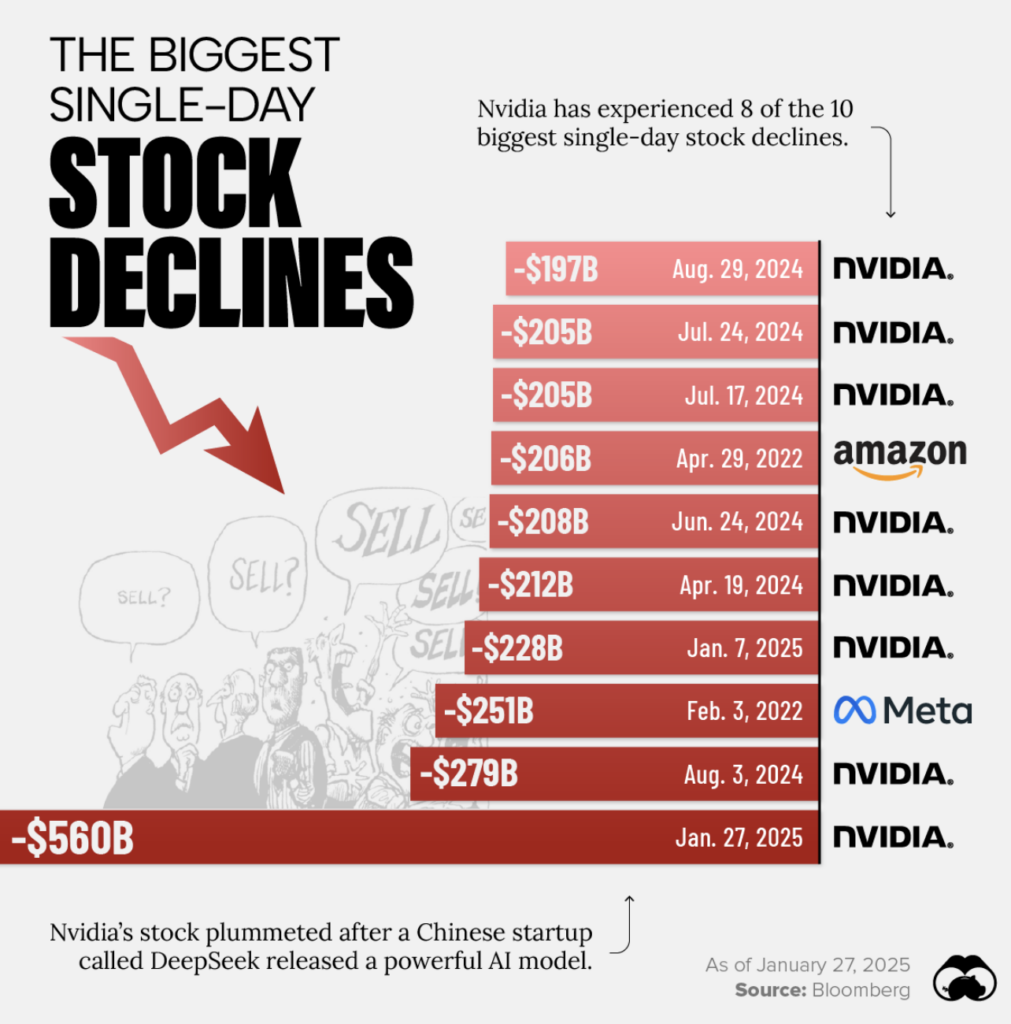

Nvidia stock price analysis: collapse of 560 billion dollars

As mentioned, Nvidia’s shares were the most affected by the debut of DeepSeek, which has generated significant concerns regarding the American company’s ability to maintain its dominant position.

In a single day, the giant of video cards saw as much as 560 billion dollars in market capitalization evaporate.

This is the largest daily collapse in history for an American stock: interesting to note how Nvidia appears 8 times in the 10 cases of greatest decline.

The last drawdown of this magnitude occurred on August 3, 2024, when the Santa Clara company lost 279 billion dollars.

Overall, Nvidia shares lost 16.97% yesterday, creating a large gap in the chart between daily closing and opening prices.

The sales, accompanied by volumes of 800 million shares, have brought the prices well below the EMA 50, thus worsening the technical structure.

Already on Friday, January 24, Nvidia had shown weakness by losing 3 percentage points: with the latest plunge, however, the risk is that of facing a bear market.

It will be very important to see how the American company will react to DeepSeek’s attack, and if it will manage to regain ground on the speculative front.

For the moment, it seems that there is solid support from the demand around 110 dollars, where new bear incursions could be repelled.

Despite the collapse, several analysts argue that the stock can still recover, especially if Nvidia manages to innovate and adapt quickly to the new market dynamics.

Today the premarket quotes indicate a value of 123.62 dollars for NVDA, up by 5.34%.

Crypto market AI in transformation with DeepSeek: what to expect now?

The arrival of DeepSeek has not only impacted the stocks of technology companies like Nvidia, but has also had significant repercussions on the world of AI crypto tokens.

Yesterday, Bitcoin dropped sharply along with the entire US tech sector, temporarily falling below $100,000.

In a single day, the quintessential crypto asset recorded a drop of 5.2%, negatively affecting the entire altcoin sector.

The AI tokens have not gained positive traction from the advent of a new Chinese model, but they too have accompanied the bear movement.

Despite this, investors are betting that yesterday’s crash may be solely linked to the correlation with the American stock market and that there may soon be a recovery.

It is not yet clear how and to what extent DeepSeeker can influence the value and function of AI crypto tokens, but it is likely that its advent will attract new attention from a speculative spectrum.

The ability of this AI model to process enormous amounts of data could improve the performance of tokens, making them more efficient and reliable. Furthermore, the adoption of DeepSeek could stimulate the creation of new tokens and platforms, opening new bull opportunities for investment.

It is important to keep in mind that there are significant concerns regarding the centralization of technological power related to this new Chinese frontier.

There is indeed talk of censorship, of data capture such as IP address, keystroke sequences, and information about the device used.

Some users also report (there are no official sources) that the Chinese startup may have lied about the production costs of DeepSeek and the low demand for GPU.

Just fyi, @deepseek_ai collects your IP, keystroke patterns, device info, etc etc, and stores it in China, where all that data is vulnerable to arbitrary requisition from the

State.

From their own privacy policy: pic.twitter.com/wueJokHcn3

— Luke de Pulford (@lukedepulford) January 27, 2025

Whatever the path of DeepSeek from here on, it is likely that the United States will soon respond with a new AI product, fueling this technological arms race.

This will likely shake the market once again, bringing new volatility to US stocks and new stimuli on the crypto front.

The tokens that are linked to the world of artificial intelligence could benefit from this stimulus by entering into a new positive momentum.

We still expect very interesting months for the crypto AI sector.