In recent years, the debate on the creation of a common currency for the BRICS has gained attention, but Brazil, which in 2025 assumes the presidency of the group, has decided to abandon this idea.

Rather than directly challenging the dominio del dollaro, the country is promoting alternative payment systems to facilitate trade among members. However, this strategy is not without risks, especially in the face of threats of punitive tariffs from the United States.

Brazil Abandons the Idea of a BRICS Currency

In 2025, Brazil assumes the presidency of the BRICS, the economic group formed by Brazil, Russia, India, China, and South Africa, to which countries like Saudi Arabia, Iran, and Egypt have recently been added. During its term, Brazil has decided not to promote the adoption of a common currency for the bloc, marking a clear reversal from the previous statements of President Luiz Inácio Lula da Silva.

According to government sources, the idea of a single currency for the BRICS has never been the subject of in-depth technical analysis and, consequently, will not be discussed at the next summit. This crucial meeting will be held in Rio de Janeiro on July 6-7, 2025, and will represent a strategic moment for the future of economic relations among the member countries.

At the center of the summit will not be the creation of a common currency, but rather the promotion of alternatives to the dollar for international trade. Brazil intends to propose solutions to reduce dependence on the US currency, facilitating trade exchanges in local currencies. This approach aims to make transactions more efficient and less vulnerable to the fluctuations of the dollar in global markets.

Dependence on the United States and the threat of tariffs

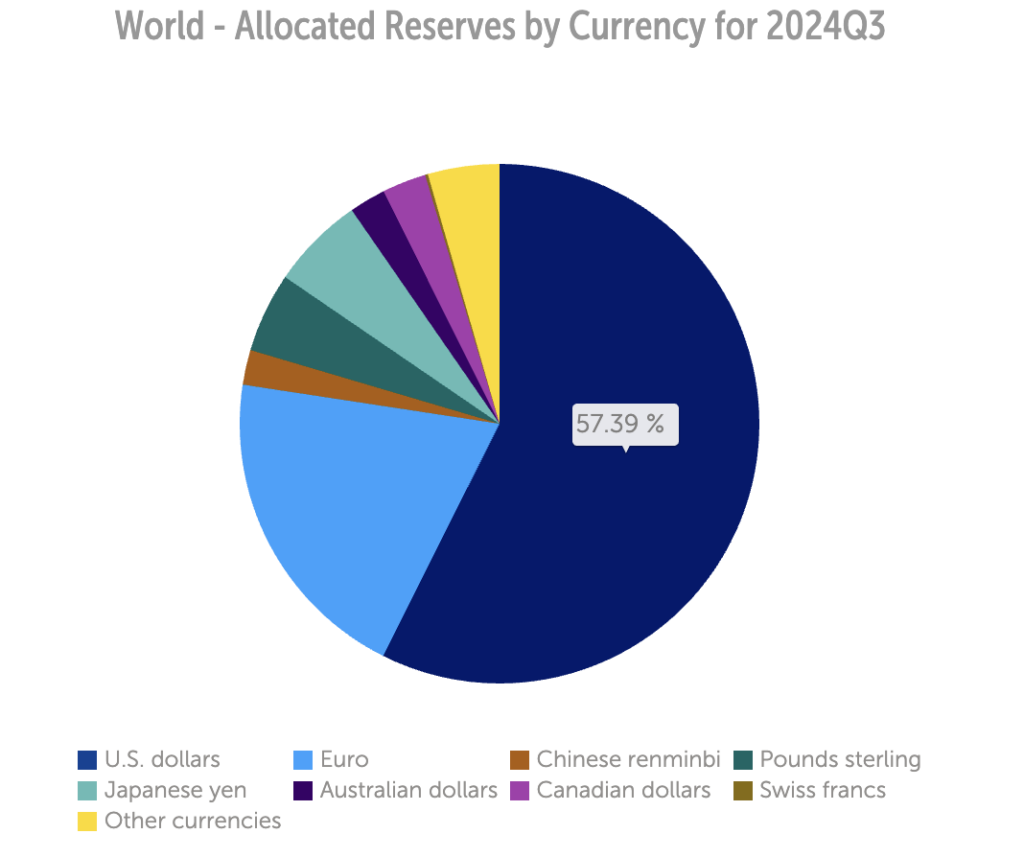

Even today, the US dollar dominates international trade and finance, forcing the BRICS countries to find an alternative to reduce their dependence on the United States and strengthen the economic sovereignty of the bloc. According to the International Monetary Fund (IMF), about 90% of foreign exchange transactions involve the dollar, making it an almost indispensable currency for global exchanges. Furthermore, 57% of global currency reserves are held in dollars, confirming its leading role in the international financial system, although this percentage is in sharp decline compared to ten years ago, when it exceeded 65%.

For this reason, any attempt by the BRICS to reduce the influence of the dollar is perceived as a threat by the United States. The former president and current candidate Donald Trump has clearly expressed his opposition to any de-dollarization initiative, threatening 100% tariffs on BRICS countries’ exports if they tried to replace the dollar in international trade. This aggressive stance by the United States reflects their willingness to defend the dollar’s primacy and discourage any attempt to create a multipolar financial system that could reduce its influence.

The possibility of heavy U.S. tariffs could have significant consequences for the BRICS bloc. For example, Brazil annually exports over 40 billion dollars of products to the United States, mainly raw materials such as soy, iron, and oil. The imposition of punitive tariffs on these goods could have a negative impact on the Brazilian economy and those of the other group members, making international trade more complex.

However, not all BRICS countries are on the same page regarding the reduction of the role of the dollar. While Russia, China, and Iran are actively pushing for de-dollarization, India and Brazil are showing more caution, preferring to focus on alternative payment systems rather than the introduction of a single currency.

Brazil and the development of international payment systems

Even giving up the idea of a common BRICS currency, Brazil is working to develop financial infrastructures that can facilitate trade among the members of the bloc without going through the dollar. Among the most relevant initiatives is the adoption of the Brazilian instant payment system (Pix), and the expansion of the Local Currency Payment System (SML).

Launched in 2020, Pix quickly revolutionized digital payments in Brazil, surpassing cash, credit cards, and bank transfers in popularity. The system was designed to be easily integrated with other international payment methods, paving the way for its expansion into BRICS markets.

The new President of the Brazilian central bank, Gabriel Galípolo, emphasized that Pix could become a model for the interconnection of the BRICS payment systems, reducing transaction costs and accelerating financial operations among member countries.

In parallel, Brazil already uses the SML (Sistema de Pagamento em Moeda Local), which allows direct transactions between Brazil, Argentina, Uruguay, and Paraguay without the need to convert currencies into dollars. In 2023, trade with Argentina through the SML reached 5.1 billion Brazilian reais (about 878 million dollars), a significant figure but still marginal compared to the total bilateral trade between the two countries. The integration of the SML with other digital payment systems could make these transactions faster and more efficient, encouraging their use on a larger scale.

“`html

The adoption of technologies such as the blockchain and the interconnection of the BRICS payment systems are other possible solutions that Brazil is considering. The goal is to reduce the need to go through the Western financial system, simplifying payments and making trade more independent from traditional reserve currencies.

“`

The impact of the BRICS strategy on Europe

The decision of Brazil to abandon the idea of a common BRICS currency, while continuing to promote the use of local currencies in trade exchanges, could have consequences also for Europe. The European Union, in fact, maintains significant economic relations with the BRICS countries, with exports in 2023 exceeding 400 billion euros. China, India, and Brazil represent key markets for European companies, with sectors such as the automotive, pharmaceutical, and agri-food industries particularly exposed.

If the BRICS bloc were to accelerate the process of de-dollarization, favoring payments in local currencies or introducing new financial systems independent of the dollar, European businesses might have to adapt to new commercial dynamics. In particular, companies might find themselves managing payments in yuan, rupees, or Brazilian reals, with possible impacts on transaction costs and the stability of financial flows.

Furthermore, the threats of US tariffs against the BRICS, if implemented, could cause indirect repercussions on Europe. If countries like Brazil and India faced export restrictions to the USA, they could redirect their exports to the European market, increasing competition for local producers. At the same time, a deterioration in relations between BRICS and the United States could push Europe to reassess its trade strategies, balancing relations between the West and emerging economies.