Bitcoin’s value in recent days has seen a correction from the local top of $31,000, touched on 14 April, to the current $28,000.

Meanwhile, many BTC belonging to wallets associated with the now-defunct Mt. Gox cryptocurrency exchange have returned to the network after they had been dormant for 10 years.

What’s going on?

Full details in this article.

Bitcoin’s value falls below $30,000: more than 2,000 BTC associated with Mt. Gox return active

Bitcoin has been struggling to keep its price above $30,000.

Over the past 3 days, Bitcoin’s value has declined 8.25% while it waits to find a support zone within the $27,000 to $28,000 range.

Nothing serious apparently in a market as volatile as that of cryptocurrencies, given and considering that BTC from mid to the previous week was up more than 35%.

Meanwhile, a very interesting detail stands out to the eye in this price correction phenomenon.

According to on-chain data, one address transferred several Bitcoin worth $60 million after being inactive for 10 years.

In detail, these are 2,071.5 that have remained dormant since 19 December 2013.

What is most striking, however, is the fact that these Bitcoin belong to an address associated with the Mt. Gox saga.

Moreover, the same address is linked to two wallets that made a 10,000 BTC transaction last summer after 9 years of inactivity.

The news has been making the rounds among Bitcoin protocol supporters and crypto news outlets.

Blockchain researcher Taisia, the administrator of the Telegram channel “GFISchannel,” believes these addresses could be linked with the hacking of the defunct crypto exchange that made some 850,000 BTC disappear, the highest figure recorded in a cryptocurrency cyber heist.

According to on-chain analysis expert Taisa, the wallet in question could belong to Jed McCaleb, original owner of Mt. Gox and founder of Ripple.

If this indiscretion is confirmed, it would be a scandal for the crypto community, since McCaleb sold Mt. Gox in 2011 to Mark Karpelès and after 3 years the latter declared the company bankrupt.

How did McCaleb come into possession of these BTC and why is his address associated with the exchange hack? What if he was the one who hacked Mt.Gox?

Did the value of Bitcoin fall because of the sale of these BTC?

Many believe that the sale of the 2,071.5 BTC that remained dormant for several years caused a drop for Bitcoin‘s value.

However, this was probably not the trigger for the BTC retracement.

If we compare the magnitude of the movement of these funds with the trading volume of Bitcoin in the past 24 hours, we realize the large difference in the order of magnitude of these figures.

In fact, $60 million does not compare to the $21 billion traded in the last day of trading.

Much more likely to cause the price drop were other factors, such as the negative effect generated by the unstaking of ETH after the Shapella update.

Or, as mentioned above, the drop in the value of Bitcoin is not to be explained by any particular event, but simply by the fact that there has been more selling than buying, and this has led to a price drop in a market that is so volatile and so illiquid at this time.

What is certain is that the selling of the more than 2,000 BTC that are related to MT. Gox are not the cause of these recent movements.

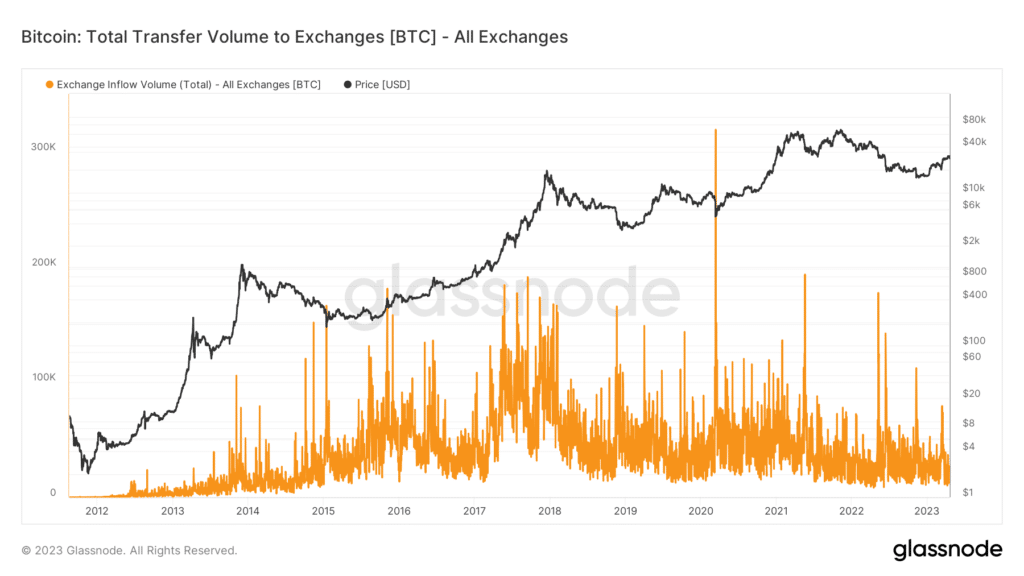

In support of this, it is interesting to note that the recent inflow of Bitcoin poured into all exchanges is decidedly low when compared to days when deposits exceeded the 150,000 BTC threshold.

On 19 April, the day when the shift of dormant Bitcoin took place, there was a decidedly low inflow on the exchanges, below 25,000.

This means that the news did not cause massive selling on the exchanges.

How many BTC were trapped inside Mt. Gox?

Before touching on this sensitive point, let’s take a step back in history.

For those who don’t know, Mt. Gox was one of the first as well as largest crypto exchanges in the 2010-2014 era, handling over 70% of the trading activity on Bitcoin and all other cryptocurrencies.

At that time there were not many crypto service providers, hence Mt. Gox was the “safest” and most convenient choice for investors.

In February 2014, the largest hack in crypto history occurred, stealing 850,000 BTC from the exchange, although truth be told Mt. Gox had suffered other attacks in 2011 as well.

The exchange owned by Mark Karpelès declared bankruptcy and a long legal battle began between creditors and bankruptcy attorneys.

After 7 1/2 years, the repayment plan began for users who had funds on Mt. Gox before it was hacked.

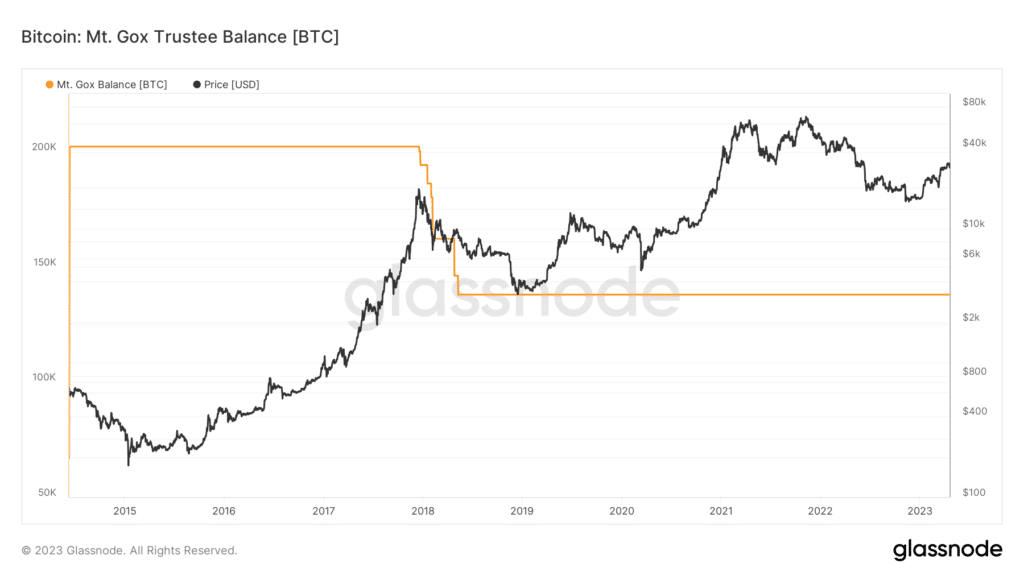

In the meantime, 202,105.97 BTC has been recovered and partially sold to return the amount lost to investors.

To date, there are 137,890.98 BTC left in the Mt. Gox saga that will be liquidated over time.

The remaining 64,214.99 BTC were sold by the Mt. Gox Trustee between December 2017 and May 2018.