eToro prepares for a turning point: Yoni Assia, CEO of the platform listed since May on Nasdaq, confirmed in an interview on Fortune the opening towards its own blockchain to support millions of monthly transactions and accelerate the offering of new digital assets such as tokenized stocks on Ethereum.

What is eToro’s proprietary blockchain and why is it needed?

Assia stated that the current blockchain infrastructure is not enough to support the enormous volume of transactions managed by eToro every month. “We cannot handle millions of monthly transactions on the existing networks,” explains the CEO. For this reason, eToro is considering a sidechain: a “light chain” connected to a main blockchain, capable of handling faster and cheaper operations while maintaining the security of the main system.

The company is in advanced negotiations with 4 or 5 platforms to choose technology partners, but has not yet named any. No launch is expected soon, but the direction is clear: with a proprietary blockchain, eToro aims to enhance the entire ecosystem, from trading to digital assets, up to interoperability between wallets.

What changes for users with the tokenization of stocks?

Assia has announced the tokenization of the most popular stocks and ETFs in the United States, directly on Ethereum. The tokenization process transforms traditional stocks into digital ERC20 assets (the token standard on Ethereum), making it possible to trade, transfer, and automatically manage trading 24/5, against the current limitations of stock market hours.

At launch, there will be 100 tokenized stocks and ETFs, including the major USA names. European users will initially be able to access through a dedicated waiting list, with the promise of subsequent expansion.

The tokenized shares will be transferable between eToro digital wallets, paving the way for decentralized finance even for regulated securities. A strong advantage, considering that other competitors (like Robinhood) are taking similar steps, but amid many regulatory concerns.

How does eToro fit into the race for the tokenization of Wall Street?

After the announcement, Bloomberg confirmed that eToro’s initiative follows Robinhood’s, which promised tokenized assets for European customers. However, unlike Robinhood, eToro has chosen a standard technology (Ethereum, ERC20) and gradual access methods (waitlist, Europe only initially) to avoid controversies and regulatory risks.

Robinhood has had issues after an airdrop of “OpenAI tokens” turned out to be a derivative contract and not actual equity: the news sparked criticism from US regulatory bodies. eToro focuses instead on transparency, compliance, and a step-by-step approach: each tokenized asset corresponds to real underlying stocks or ETFs.

The transferability wallet-to-wallet brings traditional finance closer to the principles of DeFi (decentralized finance), where control remains in the hands of the users, albeit on regulated infrastructures.

What is the market response: Is ETOR losing ground?

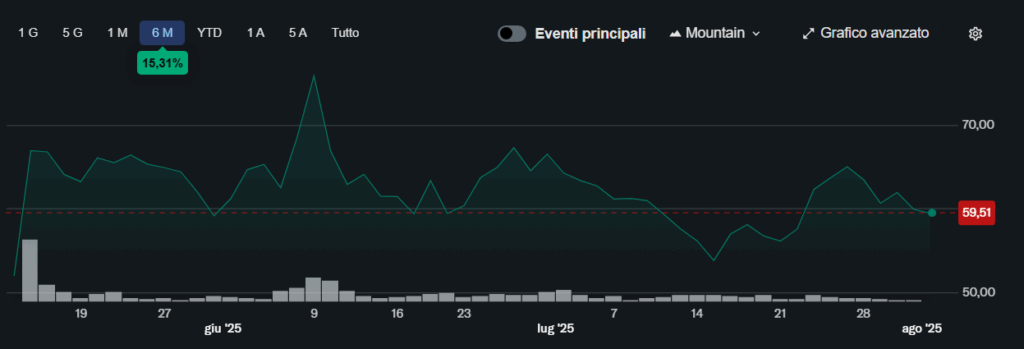

Despite the news, the price of ETOR (the eToro stock listed on Nasdaq) experienced a decline: -4% on June 18, closing at 60 dollars per share, compared to the record of 79 dollars reached on June 10, for an overall loss of 24%. The market seems to be waiting for concrete evidence on the effectiveness of the blockchain model and the real potential of large-scale tokenization.

TradingView shows the downward trend in the last week, with investors closely watching the actual adoption of tokenized shares and future partnerships in the blockchain sector.

“`html