In this article we try to take a local mind and analyze the general situation in the crypto market to understand what are the most likely scenarios and forecasting about Bitcoin’s future value.

Yesterday, the industry’s leading cryptocurrency was challenged by the news regarding the SEC’s lawsuit against Binance: what is going to happen?

Let’s take a look at it below.

Bitcoin’s future value forecasting after the SEC’s lawsuit against Binance

At this very moment, making predictions about the value of Bitcoin is really difficult, especially after the heavy news that broke yesterday afternoon, shaking the balance of the market

The US “Securities and Exchange Commission” (SEC) has filed a civil lawsuit against Binance companies and its CEO Changpeng Zhao citing 13 different allegations.

Specifically, the US agency alleges that Binance offered investors sales of unregistered securities such as BUSD and BNB, while also highlighting a wide range of tokens that fall under the category of “security.”

In addition, according to the charges filed, the exchange is allegedly guilty of pumping up trading volumes over the past two years by mixing users’ assets with those managed by CZ and other affiliates in a totally illegal manner.

Binance and its founder immediately denied this, saying they will “vigorously defend their platform.”

The news immediately had negative repercussions on the crypto market, causing Bitcoin’s price to stumble below $26,000 and endangering the price structure.

Although Bitcoin is not correlated in any way with Binance, it is clear that news about the world’s largest exchange in terms of volume impacts the value of the cryptocurrency in no small way.

In any case, as much as the news may have shaken investors, the SEC‘s battle against the crypto industry has been known for some time, as has the agency’s willingness to introduce a CBDC dissemination program into its agenda.

Coinbase was also recently attacked by the commission and its chairman Gary Gensler, but without culminating in doomsday scenarios.

Bitcoin may have difficulty regaining a bullish structure in the coming weeks, but it is not in serious danger.

Even Binance does not seem to have been heavily affected, registering a sizable but not particularly worrisome volume outflow.

What seems most evident is the attempt by the powers that be to uproot a world that has already made its bones for years and is now ready to respond with a knife between its teeth.

However things go, Bitcoin will hang on with or without the SEC’s charges and with or without Binance.

Short- and medium-term forecasting for Bitcoin’s value: 20K coming soon?

The SEC’s charges came with impeccable timing, hitting the crypto market in a weakened situation and changing the short-term forecasting of Bitcoin’s value.

While until recently we could most probably expect an upward rebound in the crypto asset, especially if the Fed (as expected) would not raise interest rates for this month, the scenario has now changed.

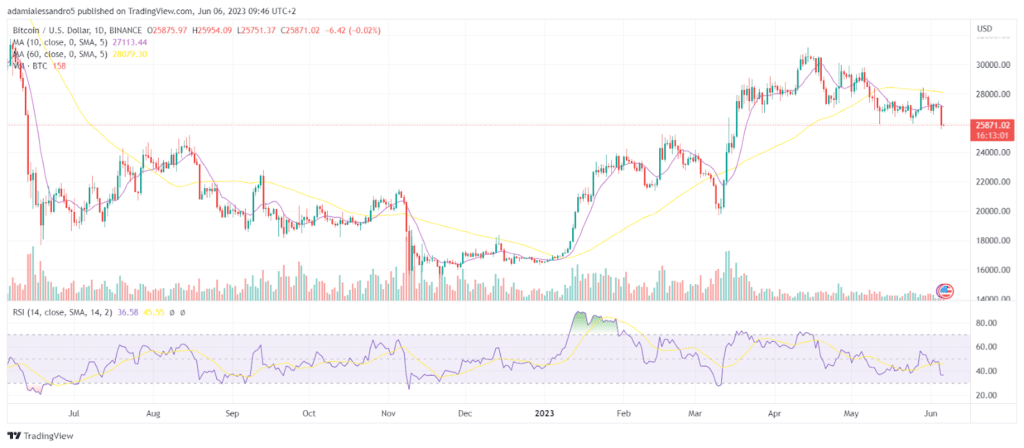

The short-term structure is blatantly bearish with all indicators trending short: the first support zone is the $23-25,000 level and the next one is around the psychological threshold of $20,000.

A break of the latter level, although still unlikely, could result in a prolonged continuation of the bear market, at least until the end of the summer.

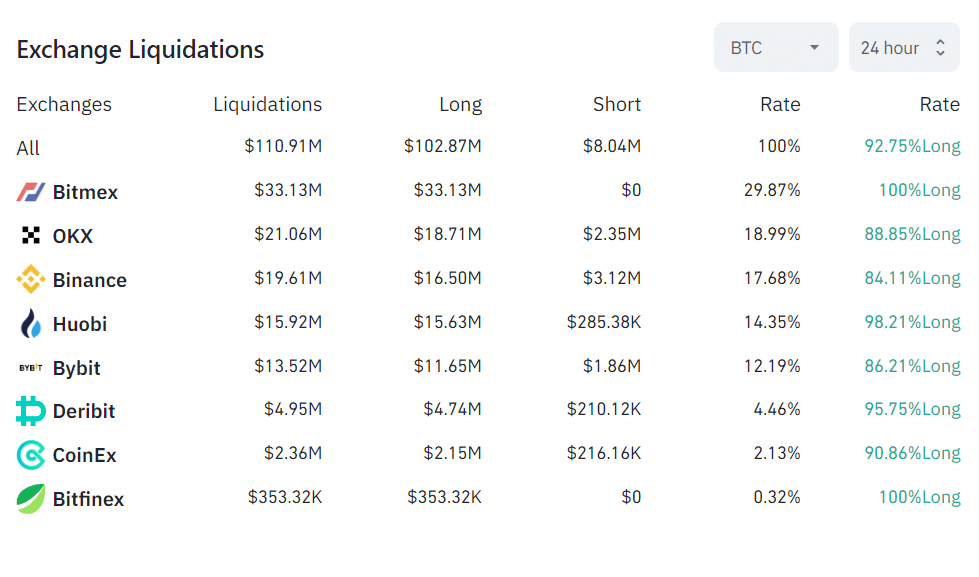

Unfortunately, the data on the derivatives markets are not comforting: with open interest high compared to the data of recent months, there have been numerous liquidations of long positions.

Despite the fact that many traders positioned themselves with the view of a bullish return in the short term, things have gone the other way, causing a long squeeze and a chain of liquidations in the last 24 hours.

However, although the odds in the short term play in favor of a downturn, in the medium term things have not changed at all.

Macroeconomic data speak of a possible recovery in the economic situation by the end of the year or early 2024 at the latest, with a mildly recovering US labor market and the prospect of the end of quantitative easing.

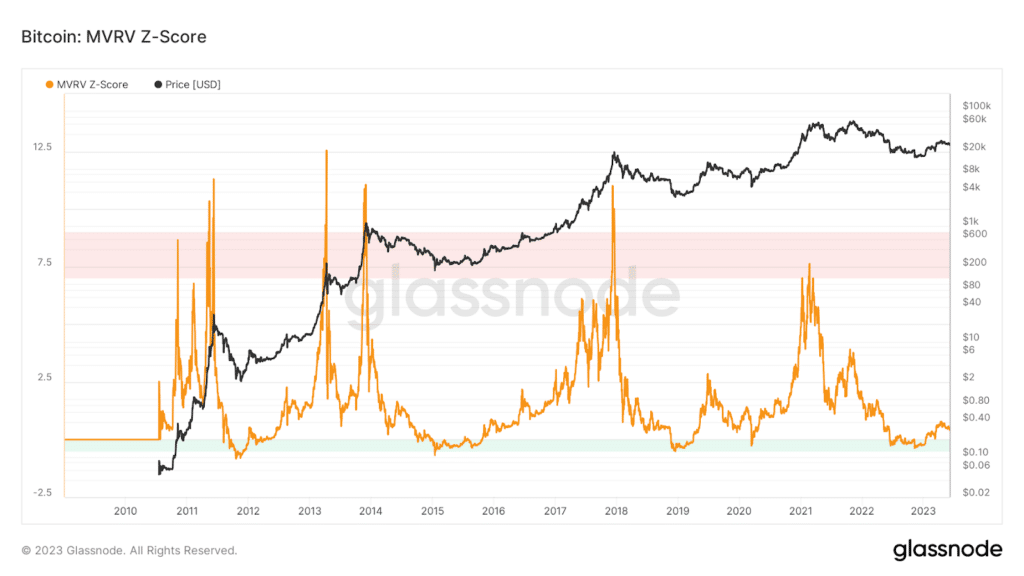

Bitcoin’s cyclicality, which has worked through 3 different market cycles so far, indicates to us that 2024 could be the right year for a bullish market return.

Meanwhile, data on Bitcoin’s network continues to improve, with an increase in active addresses and computational strength of the network.

Likewise, developments related to new technologies such as the Lightning Network and inscriptions protocols are positive.

In this sense, Bitcoin, by analyzing the macro situation and on-chain data, in common agreement with the MVRV Z-Score technical indicator indicating the “fair value” of the asset, could be highly undervalued at the moment.

Arthur Hayes’ analysis of Bitcoin

Arthur Hayes, a very famous crypto trader, published his own study a few days ago in which he talked about predicting the future value of Bitcoin.

The trader, reported to be the youngest African American crypto billionaire in history, is particularly bullish on Bitcoin’s situation.

Although his analysis came before the SEC’s announcement that it will fight Binance’s empire, this changes nothing.

According to Arthur Hayes, this summer will see the bottom in terms of the US Federal Reserve raising interest rates, resulting in the beginning of a market recovery.

In addition, the US debt crisis could favor assets that serve as a store of value such as gold and Bitcoin, increasing their preciousness and market price.

The stagnation of trading volumes on crypto trading platforms would only be a temporary situation, and we could see a return of a bull market soon.

In particular, the crypto billionaire believes that Bitcoin could resume its bullish structure between Q3 and Q4 2023, hence between late summer and early fall, in line with likely changes in US monetary policies.

In his view, Bitcoin will never again return below $20,000, but may only approach down there.

If so, this could be a great time to accumulate satoshis, especially now that retail and small investors, scared to death by the SEC‘s bullying, are liquidating their positions in the market.

As the good old Baron Nathan Rothschild used to say, “The time to buy is when there’s blood in the streets.”