Great news from the crypto world: Bitcoin wallet with more than 1 BTC on their balance sheet have reached one million for the first time.

This is yet another success for the Bitcoin ecosystem, which is growing more and more both in terms of holdings and the security and usefulness of the network.

All the data below.

Bitcoin wallets with more than 1 BTC reach 1 million units

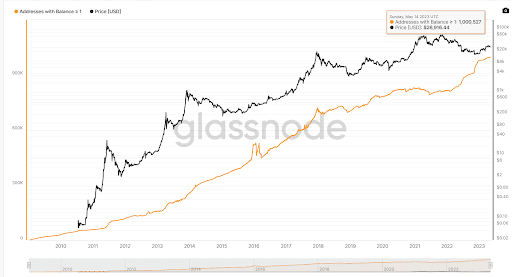

An important milestone was reached on 13 May: Bitcoin wallets with more than 1 BTC surpassed the 1 million-unit mark, demonstrating growing industry interest despite uncertainty on the price front for the market’s leading cryptocurrency.

In total, since early February 2022, when Bitcoin’s price was around $40,000, about 190,000 “wholecoiners” have been added as the crypto continued its distribution phase following the previous year’s rally.

The figure is very pleasing to the crypto community given that in the bull-bear cycle of 2017-2018, during the bearish phase of prices, Bitcoin addresses with more than 1 BTC on the balance sheet declined by 23 thousand.

In contrast, from the top of the last bull run to the bottom (at least for now) in November 2022, the trend has been the opposite and we have seen an increase in wallets holding more than 1 BTC for a total of 110 thousand more units.

This makes us realize that while in 2018 many investors were giving Bitcoin a pass, they are now taking advantage of the discounts in the markets to add satoshi to their wallets.

To this end, Negentropic, co-founder of the on-chain analytics firm Glassnode, from which we extrapolated data related to this news, stated on Twitter that “The best time to buy Bitcoin is when there is blood in the streets.”

It is also important to remember that although the maximum supply of Bitcoin is set at 21 million coins, some of this supply may have been lost forever.

It is estimated that about 3 million BTC, or about 17% of the circulating supply is unrecoverable: this includes wallets with lost private keys and large wallets that have been inactive for more than a decade.

If we combine this figure with the balance of Bitcoin that are in all centralized exchanges, such as Binance and Coinbase, we can come to the conclusion that the true supply (understood as that which is actually available, excluding exchanges) amounts to just over 16 million coins, of which 1.63 million have yet to be issued on the blockchain.

As a result, reaching 1 million addresses holding more than 1 BTC further highlights the scarcity this asset enjoys, hinting that if the trend continues at this rate there could be a “supply shock” soon that will send the cryptocurrency’s price soaring.

The Bitcoin network is getting stronger and stronger: mass adoption in sight

The Bitcoin network is growing stronger and increasingly adopted by individuals and public institutions, who are using it to transfer money in a trustless manner through a public digital ledger of transactions.

Liechtenstein‘s prime minister recently proposed that its citizens pay for government services using the Bitcoin cryptocurrency. In the wake of what happened during 2021 with El Salvador, and in parallel with the probable adoption of less developed countries in need of an alternative currency to classic fiat currencies suffering from inflation which is crushing citizens’ purchasing power.

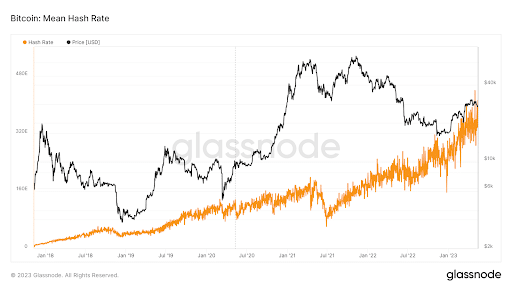

On the network security front, we can see how the hashrate, or the computational power that protects the network from cyber attacks, has reached a new all-time high just this month.

This kind of data tells us how attractive the Bitcoin mining industry still is and how much the latter has grown in recent years.

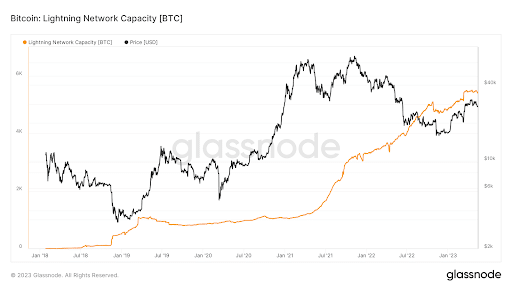

Moreover, the Bitcoin network, although it was created exclusively for transferring money from one address to another and not for ordinary everyday transactions, has been experimenting in recent years with the possibility of being used for microtransactions through the implementation of the Layer 2 “Lightning Network.”

This secondary substrate, which allows cheap and fast transactions being conducted off-chain, is gradually increasing its capacity with the introduction of new lightning nodes.

Binance itself has announced that it will adopt the Layer 2 network within its exchange to allow withdrawals to be processed faster and less expensively for users.

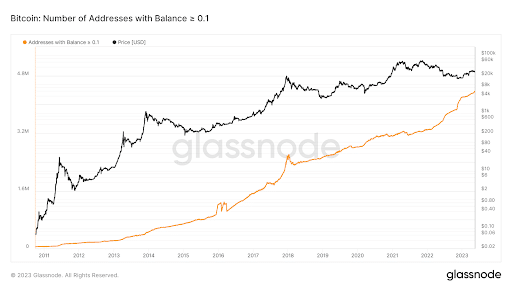

Finally, while holders with more than 1 BTC on their balance sheet have reached the round number of 1 million, smaller addresses with more than 0.1 BTC as well as those with more than 0.001 BTC are also growing increasingly.

All this fuels the odds of mass adoption in sight for Bitcoin and its network, which is improving in every respect even as speculative market conditions seem to move negatively at times.

The best Bitcoin wallet where to store cryptocurrencies

As we have seen, BTC is increasingly becoming a valuable asset to be guarded carefully in a Bitcoin wallet. Even though it is especially in bearish market conditions in which time and again, players disappear who until a few months before were self-proclaimed to be able to hold their clients’ assets, as in the latest case of FTX‘s bankruptcy.

Satoshi Nakamoto invented Bitcoin as a P2P electronic payment system, implying that the coins used in this process should remain within personal wallets and not given to third-party entities such as cryptocurrency exchanges.

Given the failures and frauds of many exchanges such as Mt.Gox, Quadriga Cx and Ftx, which have created unquestionable damage to the ecosystem, it would be wise to understand that Bitcoin custody must be done independently if one does not want to take counterparty risks.

The best Bitcoin wallets in this regard are non-custodial ones, where possession of the private keys remains with the wallet owner.

In the crypto world, the saying “Not your keys, not your coins” is very famous precisely to mean that without the access keys to sign transactions from your wallet, you are not really the owner of these assets, but at most you remain a creditor to someone who holds them for you.

The best non-custodial wallets where you can deposit BTC and let them age without the fear that these will disappear in the next few years are Ledger and Trezor, both hardware wallets.

There are actually still very secure and practical software wallet versions such as Electrum, Wasabi wallet, Armory and Unisat.

The latter also allows the creation of fungible NFTs and tokens via inscriptions on individual satoshis from the Ordinals protocol, created by Casey Rodarmor, a developer of Bitcoin Core.

My recommendation for bitcoiners: always be in control of your Bitcoin yourself and never share the private keys of your wallet with anyone, not even your relatives!

When in doubt, better not to trust anyone and rely on the technology.