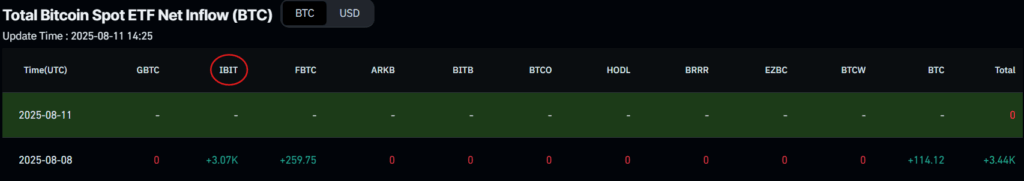

Last Friday, the stock market session ended with a remarkable dominance of the BlackRock ETF compared to the other spot Bitcoin ETFs.

In fact, in the face of total net inflows slightly above 400 million dollars, IBIT had as much as 360 million.

In other words, 90% of the inflows went to BlackRock’s ETF, leaving all other ETFs combined with only the remaining 10%.

The dominance of BlackRock’s spot Bitcoin ETF

Note that historically this dominance appears to be less pronounced.

Since they were launched on the US exchanges, in January of last year, in total the spot Bitcoin ETFs have gathered total net inflows of almost 54 and a half billion dollars.

IBIT di BlackRock in total has gathered nearly 57.8 billion dollars in net inflows since then, compared to just over 12 billion of FBTC, Fidelity’s ETF.

Instead, GBTC by Grayscale has overall recorded 23.7 billion in net outflows, which explains why the inflows of IBIT are greater than those of all ETFs combined.

Considering only the positive net inflows, IBIT overall attracted more than 75.5% of the total, followed by FBTC with more than 15.5%. All the others together account for less than 9%.

Therefore, BlackRock’s dominance in crypto ETFs is remarkable, and it has even increased in recent days.

Ethereum ETFs

The spot ETH ETFs landed on the US exchanges in July of last year.

In total, since then, they have recorded net inflows of approximately 9.8 billion dollars.

In this case, Blackock also dominates, given that its ETHA has totaled 9.8 billion dollars in overall net inflows, followed by FETH by Fidelity with almost 2.4 billion. ETHE by Grayscale, on the other hand, recorded more than 4.3 billion in overall net outflows.

Curiously, the percentage of total net inflows, ignoring the outflows of ETHE, is almost 76% for BlackRock’s ETF, while Fidelity’s rises to 18.4%. The others had to settle for less than 6% of total net inflows.

So BlackRock also dominates the ETF market on Ethereum with more or less the same percentage.

In this case, however, on Friday the dominance was much more contained.

In fact, out of a total of 461 million dollars in daily net inflows, BlackRock’s ETHA attracted less than 255, with Fidelity’s FETHE attracting more than 132.

Therefore, yesterday’s record was focused on the Bitcoin markets.

BlackRock and the ETF on Bitcoin

Note that on Friday the price of BTC was essentially stable, while that of ETH was rising.

Today, however, BTC has risen more than ETH, at least for now, so it is possible that the overall daily net inflows on spot Bitcoin ETFs will once again exceed those on Ethereum, as often happens.