Breaking News: Bulgaria turns out to hold a Bitcoin balance of more than 200,000, even surpassing the share held by the United States.

The Bulgarian government is playing its trump card to become one of the most economically established countries in the world, hoping that its $6 billion countervalue in cryptocurrency can multiply in the future.

Let’s look at the details of the news together.

Crypto news: Bulgaria’s balance of more than 200,000 Bitcoin

The latest crypto news talks about Bulgaria and the incredible discovery of a balance of more than 200,000 Bitcoin, with a countervalue of about $6.3 billion

The huge sum was acquired by the Balkan country through a cyber seizure that took place in May 2017.

Specifically,from an investigation called “PRATKA/VIRUS,” Bulgarian authorities were able to stop a criminal group organized in the infiltration of viruses into the country’s customs computer systems.

From the 28 arrests made there, a large amount of cash, computers, communications devices, tablets, and various equipment were confiscated, as well as a staggering 213,519 BTC, or about 1% of the currency’s circulating supply

The criminal gang used cryptocurrency because of its anonymity component and the simplicity with which they could transfer value from one area of the continent to another, without incurring transportation risks.

The sum at the time was worth “only” $500 million but has now reached a significantly higher countervalue.

It is still unclear how Bulgarian law enforcement managed to seize the massive BTC stack, but some rumors in recent days claim that all the loot is still jealousy held by the country.

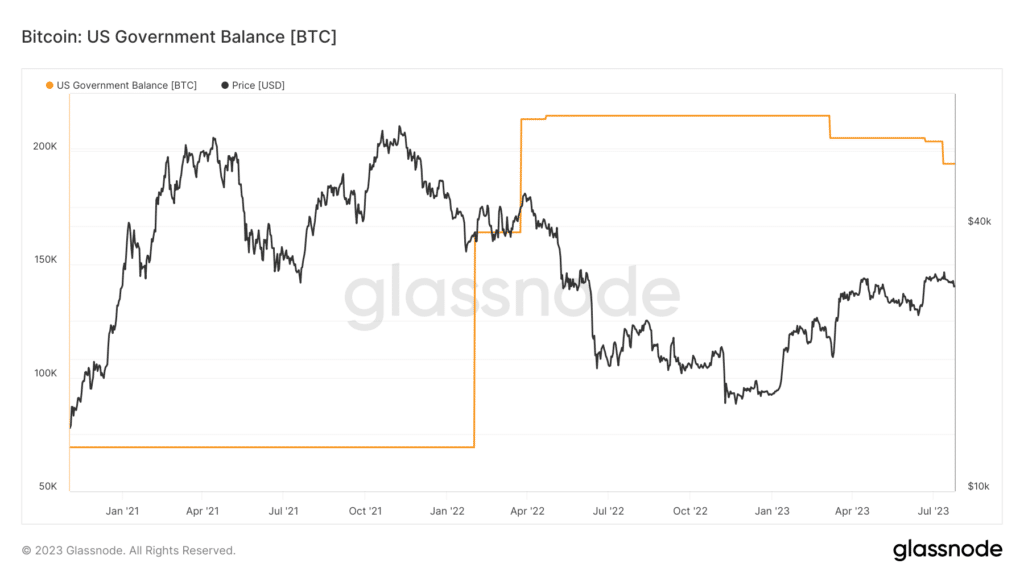

If that were the case, Bulgaria would rank hands down first as the state with the most Bitcoin in its possession, topping the US, which enjoys assets of 194,188 units of digital gold.

In this case too, the amount held by the US is the result of raids on cybercrimes: these include the cases of hacker James Zhong, the cyber heist of Bitfinex and the seizure of the Silk Road darknet marketplace.

The US government would have actually still been the world’s leading entity in terms of Bitcoin holdings, were it not for the fact that in March 2023 it sold a part of it on Coinbase and through special institutional auctions.

Bulgaria’s cryptographic future

After the latest crypto news related to the discovery of Bulgaria’s Bitcoin balances, we can go out on a limb and say that the Eastern European country may enjoy a rosy future in the coming years.

If the predictions of experts on the future price of Bitcoin turn out to be right, such as that of the consulting firm Fundstrat Global Advisors, which predicts a price of $200,000 by 2028, then Bulgaria may indeed have hit the jackpot.

At those figures, the country’s cryptocurrency countervalue would amount to $42.6 billion, about half of Bulgaria’s GDP according to 2021 figures, or three times the national debt according to 2019 figures.

At the moment, at current prices, the government would not be able to pay off even half of the liabilities it has on account.

Hence, the idea of Bulgarian heads of state preferring to hold the cryptocurrency in order to hopefully generate a condition of widespread wealth for the whole country rather than cover some patches today remains quite agreeable.

That said, the government should still look for less risky solutions in order to improve its economic fate, such as supporting the development of crypto- and blockchain-themed businesses, as is the case in Germany, Britain, Switzerland, and Portugal.

The future price of Bitcoin is very uncertain, and it may take longer than usual for the cryptocurrency to reach $200,000, hence it is always good to have an alternative plan that can exploit the potential of new technologies.

The Bitcoin standard and new decentralized infrastructures are spreading at a faster rate around the world than Bulgaria, with news reports of increasingly disruptive adoption, especially in less developed countries.

Hence, even with a fortune behind it, the Balkan country may be paying the price for lacking long-term foresight and taking a passive approach to technology development, losing out on several tens of billions of dollars in future profits.

Government Holds $6 Billion Worth of

Government Holds $6 Billion Worth of