Breaking: The US government is arranging a rescue plan for First Republic Bank in the wake of the bank’s shares losing 60% on the NYSE in just one week of trading.

In the first four months of 2023, the bank experienced deposit outflows of more than $100 billion, bringing the stock to its knees and negatively affecting the entire regional private banking sector.

Let’s look at all the details together

The US government plans to bail out First Republic Bank as the stock plummets

The US government led by the Biden administration is holding a confidential meeting to arrange the rescue of First Republic Bank and its stock, which has plummeted in recent days of trading in the markets.

Meanwhile, private bank executives are scrambling to forge an agreement with US regulators to avoid a forced takeover.

It is not yet known why the US government, faced with the aggravating problem of inflation, would consider injecting liquidity to bail out a regional private bank, nor are the sources of this news known.

What we do know is that other players such as banks and private equity firms are also sitting at the negotiating table.

Meanwhile, the management of First Republic bank said in a note in the last hours:

“We are engaged in discussions with multiple parties about our strategic options while continuing to serve our customers.”

First Republic became the epicenter of the US regional banking crisis in March, after a bank run was triggered by depositors to withdraw all deposits made on the institution, which is facing bankruptcy.

Discussions about liquidity support for First Republic Bank have been active since 16 March, after 11 of the largest US lenders deposited $30 billion to stem the crisis and avoid the worst, as happened with Silicon Valley Bank and Signature Bank.

From this week, though, pressures have been mounting as the private bank announced that outflows on deposits of more than $100 billion were recorded in the first four months of 2023 triggering a sell-off on the NYSE-listed stock, which has lost about 60% of its value since Monday.

US officials are considering a deal with the private sector rather than letting the FDIC administration begin liquidation operations for the insolvent bank.

However, many of the proposed options including asset sales or the creation of a “bad bank” isolating its underwater assets have so far failed to result in a deal.

It will be interesting to see whether First Republic will be able to cover the holes in its balance sheet or whether its failure will trigger the crisis of other regional institutions, resulting in damage to depositors and investors.

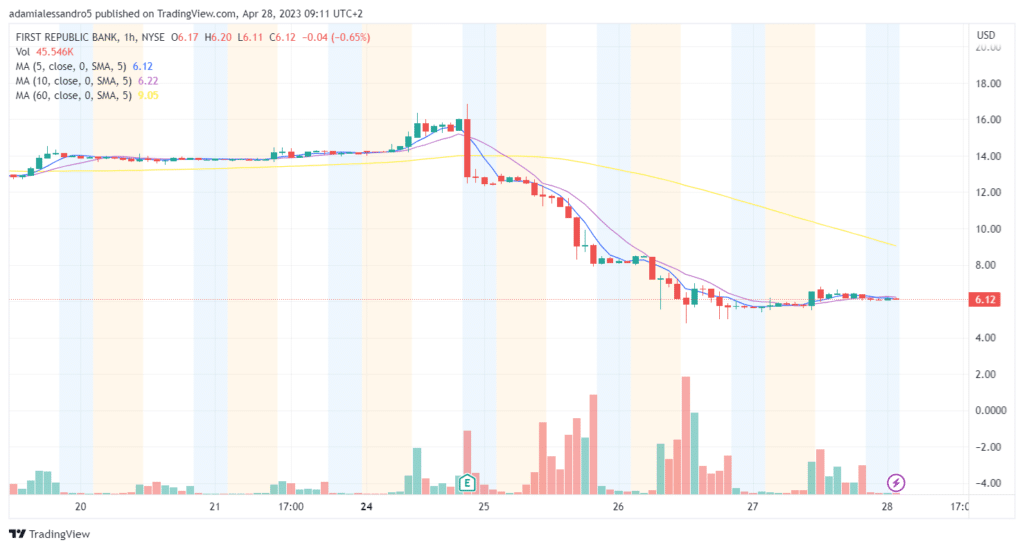

The collapse of First Republic Bank shares.

Since the beginning of this week, First Republic Bank’s stock has plummeted on the NYSE market precisely because of the leak of the news regarding the outflow of capital from the regional lending institution.

Specifically, the data speak of a run on the bank of over $100 billion, a frightening figure when we consider that the bank’s stock currently capitalizes just over $1 billion.

All Y/Y figures such as revenue, net income, net profit margin, and earnings per share have been negative in double digits, while the stock has lost about 95% since March 8, 2023.

Only in the last few hours does the stock seem to be recovering slightly, posting +8.79% on the day, fueled by hopes of a bailout with cash injections from the government.

IMMAGINE _________________________________

However, the situation seems far from calm: the temporary recovery of the last few hours is only the tip of the iceberg of a stock that has been falling precipitously over the last 2 months.

Truth be told, $FRC has been performing disastrously in the markets for over 1.5 years, just like most banking stocks that have suffered from the Fed‘s restrictive policies and rising dollar inflation.

In the past 2 months, fears of a bank failure have multiplied, leading investors to heavily dump the stock in the markets and creating impressive selling pressure.

The chart of $FRC looks like that of a shitcoin crypto that has just performed a rug pull pulling all the liquidity in the market.

Too bad that in this case, we are dealing with the stock of an American private bank, which should have protected itself from these situations that threaten to put the entire banking sector in crisis.

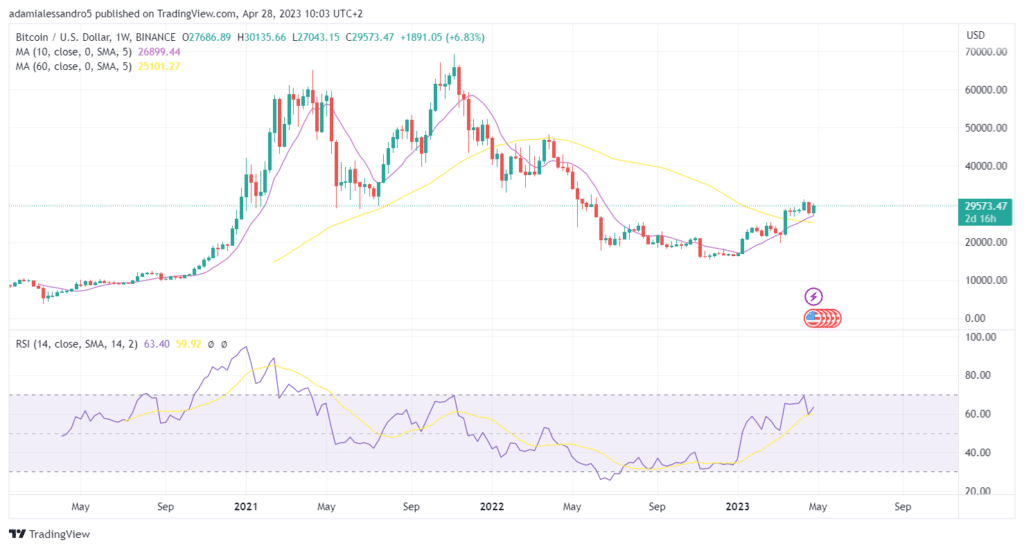

Is Bitcoin benefiting from the US banking crisis?

Bitcoin these days seems to be benefiting from the uncertain situation being experienced by small private banks in the United States, especially First Republic Bank and its stock.

In the last 24 hours, the industry’s leading cryptocurrency is up about 2%, returning to contention at the $30,000 level.

The collapse of Silicon Valley Bank and Signature Bank have been the main drivers of the crypto industry’s price rally throughout March.

Against this backdrop, Bitcoin rose 23% in 30 days as $250 billion entered the entire cryptocurrency industry.

When fears about the risk of failure spread, as in the case of First Republic Bank, investors perceive Bitcoin as a safe haven asset, able to withstand these turbulent situations, as if Bitcoin were the remedy for the ills that are triggered by regional banking crises in the US

On the other hand, the decentralized nature of cryptocurrency provides for a departure from all activities in which there is intermediation of any kind, in line with the ideals of P2P money.

Should the US crisis drag on for months more, BTC could probably extend the rally undisturbed.

On the technical analysis front, there is a need to pay attention to the MACD, which on a weekly time frame is about to enter the overbought zone.

Although this indicator may remain in this condition for a long time, it should be considered as a warning for a possible pause in BTC’s rally in case the trend reverses.