SG Force, the crypto division of Société Générale, recently announced the introduction of a new stablecoin pegged to the value of the euro on the Ethereum blockchain.

Let’s look at the details of the news together

Société Générale and the stablecoin that takes back the value of the euro

Société Générale’s crypto division, SG Forge, announced that it has introduced EUR CoinVertible (EURCV), a stablecoin pegged to the value of the euro.

The new virtual currency will rely on the Ethereum blockchain, the world’s best-known and most secure distributed network for what concerns the deployment of new tokens.

This is the first case in which such an asset is issued by a banking institution on a public blockchain.

Indeed, the stablecoin of the US financial giant JP Morgan, JPM Coin, has been in use for more than 2 years but is only exchanged internally on the bank’s own private network and used as a settlement token between financial institutions, a sort of XRP, let’s say.

With this though, the intents are far more interesting, as EURCV will have life on Ethereum and can be traded by anyone, in a trustless way.

The bank’s Paris-based unit said the creation of EUR CoinVertible (EURCV) will serve to bridge the gap between traditional European markets and the world of digital crypto assets.

According to SG Forge’s findings, continued pressure and demand from their clients for an asset class that lives on-chain but is able to maintain a stable value pegged to that of the euro, prompted them to deliver the product.

In fact, European users who want to enter the crypto world without exposing themselves to market volatility cannot rely on many solutions other than stablecoins issued by companies outside the continent.

The new virtual currency will also be used for on-chain liquidity financing and refinancing activities.

Société Générale‘s crypto division seems to want to get serious about this new product, as it also recently obtained registration from the Autorité des Marchés Financiers (AMF), a French supervisory body, to allow its customers to trade crypto assets and hold them on the bank’s platform.

What other stablecoins pegged to the euro are there in the market besides Société Générale’s fledgling?

The news of Société Générale’s introduction of EURCV is very important because no certified European bank had issued a stablecoin anchored to the euro on a public blockchain.

In fact, all other solutions that we know of refer to stablecoins managed by private companies or institutions based outside the European continent.

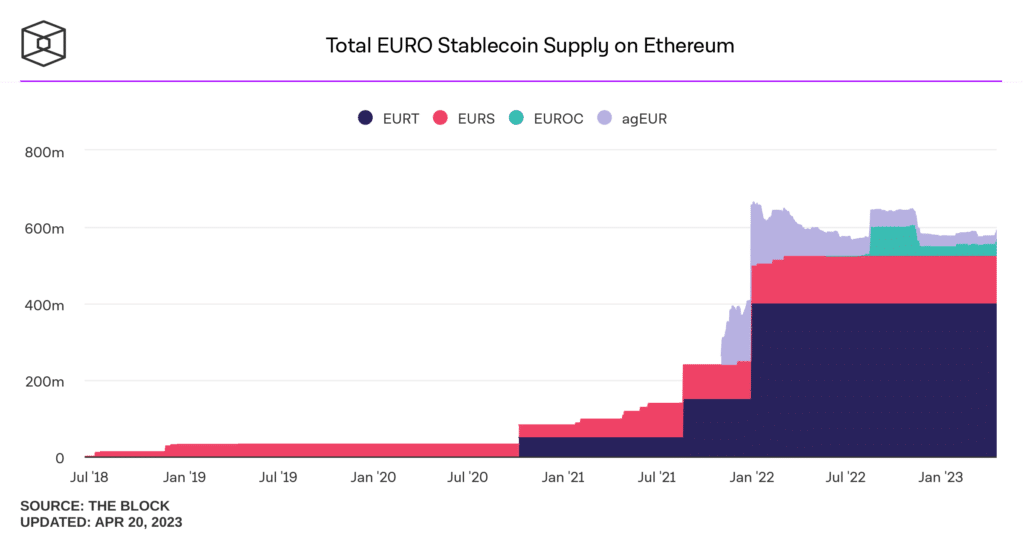

The best known euro-pegged stablecoin with the most supply on Ethereum ( and consequently the most capitalized) is EURT, a currency issued by Tether, a company that manages USDT.

The second cryptocurrency replicating the value of the euro with the most following is EURS, controlled by the Douglas-based asset tokenization company Stasis in the Isles of Man.

Finally, in reduced quantity and success in the market are EUROC and agEUR, respectively managed by Circle, which operates USDC i.e., the second most capitalized stablecoin in the world, and Angle Protocol, a decentralized platform specializing in stablecoin issuance.

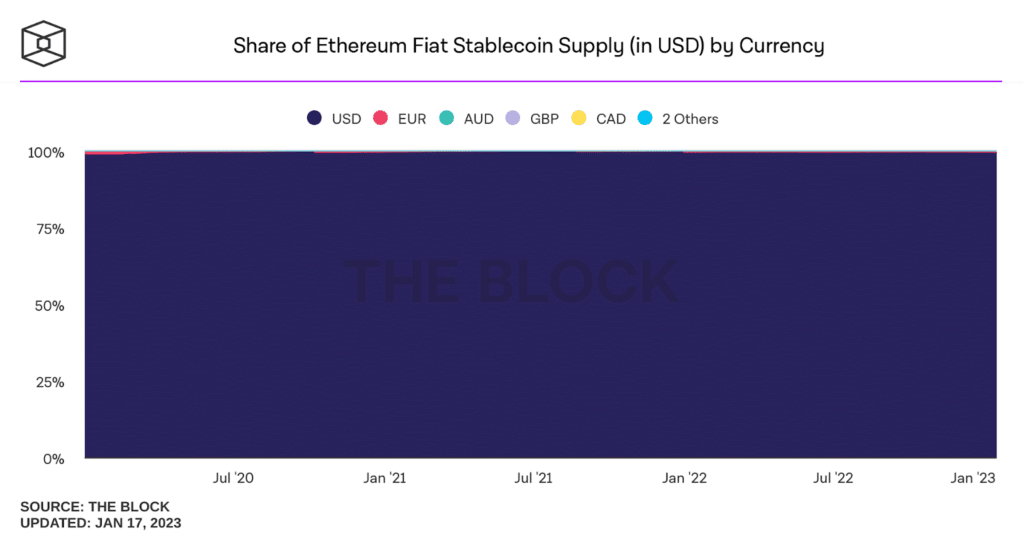

It is important to remember that the market presence of stablecoins pegged to the euro is drastically lower than those that take back the value of the dollar.

In fact, the issuance of tokens that peg to a FIAT currency began several years ago in the US and is only recently emerging as a phenomenon in Europe.

Stablecoins pegged to USD are much more liquid and much more capitalized than those pegged to EUR, and as a result they are the ones preferred by investors, whether American, Asian, African or European.

99.3% of the stablecoin market is based on assets pegged to the value of the US dollar

The risks of stablecoins

Everyone knows the benefits of using stablecoins, namely the ability to have a volatility-free currency that can be used for on-chain transactions, but few know the inherent risks of stablecoins.

Obviously these risks are infinitely less than those present in highly volatile tokens founded by unknown companies or worse yet issued by entities whose identities are unknown (with the exception of Bitcoin).

However, it is important to understand the basic concepts of stablecoin issuance to protect oneself from any risky products or scams in the market.

First and foremost, when stablecoin issuance takes place, this practice is almost always centrally managed, meaning there is a single entity that decides how to issue currency, hence potentially subject to cyber attacks or human error (in good or bad faith)

In addition, there is the concept of collateralization to consider: generally, when issuing a stablecoin, the most serious companies have a full hedge countervalue (at 100% or more) based on the units minted on blockchain.

USDC managed by Circle for example, is 100% collateralized by FIAT and short-term US Treasury bonds.

In other cases, we may come across currencies that are not fully collateralized or even worse, algorithmically collateralized.

History teaches us that stablecoins partially collateralized with volatile assets or algorithmically collateralized have had short lives, albeit intense and with much satisfaction.

The collapse of UST and the Terra/Luna ecosystem has warned investors that these types of financial products are too risky for their role.

For that matter, if stablecoins do not represent safe assets to hold in a portfolio and hence subject to volatile situations or worse crashes, why not hold Bitcoin?