A report by Greenfield Capital on the state of the crypto industry in Europe highlighted that many founders of projects based on blockchain technology are excited about the approval of the final MiCA text on crypto regulation by the European Parliament.

With this new regulatory framework, which we recall will enter into force in 12 to 18 months, service providers in Europe will be able to develop fintech solutions based on virtual cryptocurrencies with full transparency and autonomy.

Greenfield Capital study: Blockchain project founders are optimistic about the industry’s future after MiCA crypto regulation

The crypto industry in the EU is growing robustly and intensively, according to data analyzed by European investment firm Greenfield Capital.

The European Developer in Crypto Index (EDIC), which maps the resilience and growth of the European crypto ecosystem, shows a significant influx of developers in the first quarter of 2023, despite less than optimal market conditions at the price level.

The data shows the presence of 42 of the most influential cryptographic protocols and companies with a strong European presence, counting an increase of 300 more developers compared to the end of 2022.

After a challenging year for the development of the industry, with the bear market as the main driver, crypto service providers expressed their confidence in 2023 and beyond.

Many founders of blockchain-based EU projects, according to a survey conducted by Greenfield Capital, interpreted the future of the industry in a positive light, especially with the introduction of MiCA regulation in crypto.

When asked about the most important developments in cryptocurrency in 2023, 70 percent of all responses were on the topic of regulation.

In second place, 35% of respondents cited Zero knowledge technology, followed closely by “finding catalysts to drive mass adoption,” which is seen as the top challenge overall.

Project founders in Europe see the MiCA regulation of cryptocurrencies as an extremely important factor that puts the Union in a superior position compared to other continents that do not have a clear and transparent regulatory framework (even if they enjoy greater adoption).

In this context, Lisbon is considered the most important crypto hub in the world, given its centrality within the DeFi world, followed by Berlin and New York City.

In fact, many companies and projects are also attracted to the Portuguese capital for tax reasons.

Berlin, on the other hand, represents the culture of European startups, which choose the German capital due to the strong presence of developers and a proactive environment for blockchain-based companies.

Paris, ranked as the seventh most influential city, has a thriving crypto project scene and numerous Web3 and NFT ecosystems.

If the final MiCA framework is to enable the development of a thriving cryptocurrency-based economy in Europe, it will be necessary to educate the next generation on these specific issues.

In this regard, an increasing number of European universities are beginning to offer master’s programs dedicated to blockchain technology, particularly in the United Kingdom, Ireland, and Spain. In fact, many universities in Europe have planned a series of new courses for the winter semester of 2023.

What is Greenfield Capital?

Greenfield Capital is a European investment company that aims to support the process of creating future blockchain architectures, which will be created in the coming years.

Sebastian Blum and Jascha Samadi founded the company in 2018, with the goal of funding the development of crypto projects through careful analysis of the tokenomics styling stages and processes inherent to governance.

The support also consists of performing the more technical tasks of web3 infrastructure development, such as in-house execution of validators for networks and protocols.

To date, Greenfied Capital can boast 3 different crypto funds, of which the largest dedicated to cryptocurrencies in Europe, launched in 2021, has a capital of €135 million.

The company’s portfolio includes cryptos and stakes in projects such as Nym, Near, Celo, Dapper Labs, Safe, Arweawe, 1inch, The Fabricant and DressX, Liquidiy and Stakewise.

Investments cover almost all areas of Web3, from hardware components for mining to DeFi, crypto art and decentralized asset custody solutions.

The company’s goals are long term, recognizing that the industry in the EU is still at an “early stage”, focusing on the future development and evolution of decentralized products rather than focusing on short term adoption.

MiCA crypto regulation in the EU can accelerate the development of the Web3 industry.

Europe needs to catch up with the US and the rest of the world in terms of blockchain development and progress.

The long-awaited final MiCA framework has finally been approved by the European Parliament and may soon come into full effect, outlining the guidelines for crypto service providers.

What at first glance may seem like an obstacle for the industry is instead viewed positively by the most influential figures in the crypto landscape in Europe, as the presence of a crypto licensing framework will be able to help the Union compete with the rest of the world’s technological innovation hubs.

In particular, the US enjoys hegemony in terms of liquidity and market capitalization of the underlying projects.

Even on the stablecoin front, the U.S. can boast 99 percent control of such resources, which are essential to the creation of a decentralized exchange economy.

In fact, something has been happening in recent months: the fourth-largest bank by market capitalization in the Eurozone has created its own stablecoin precisely to meet the demand for these types of cryptographic solutions that are tied to the value of the Euro.

However, the situation remains largely marginal when we think about the rest of the world, when we think about the U.S. and the Far East, where cryptocurrencies are already a key part of economic and technological progress.

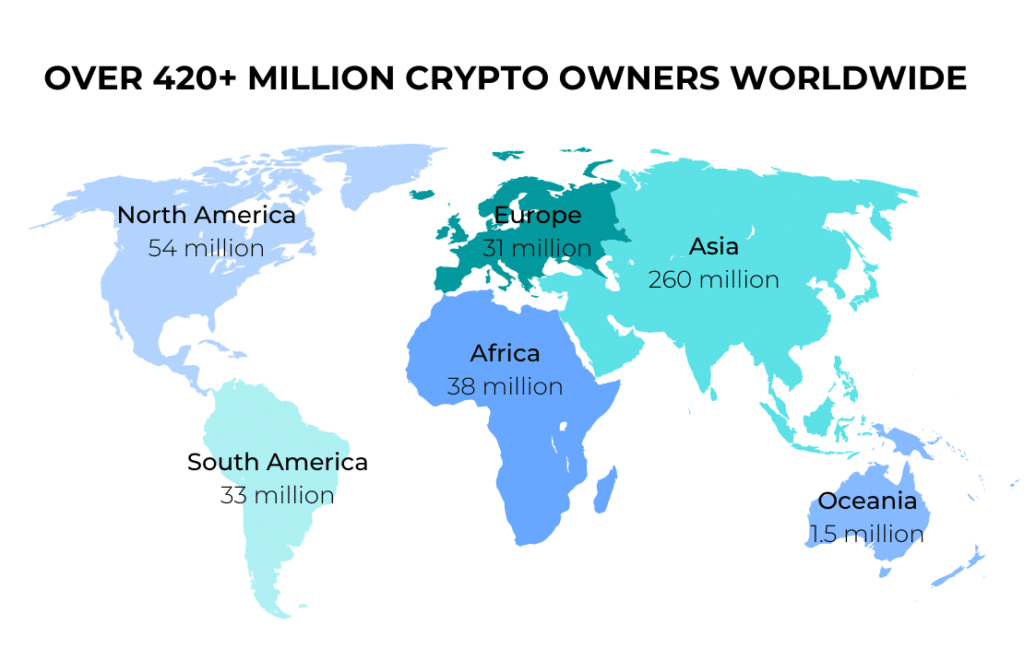

Just think of the total number of individuals holding crypto assets in Europe, which is around 31 million, compared to the more than 420 million holders worldwide.

There is still a long way to go, but from now on, thanks to a more transparent regulatory framework, it will be possible to build a more crypto future for Europe by accelerating the transition to this new technological frontier.