For a few weeks now, the price of BTC has been particularly high, but today it is unusually so.

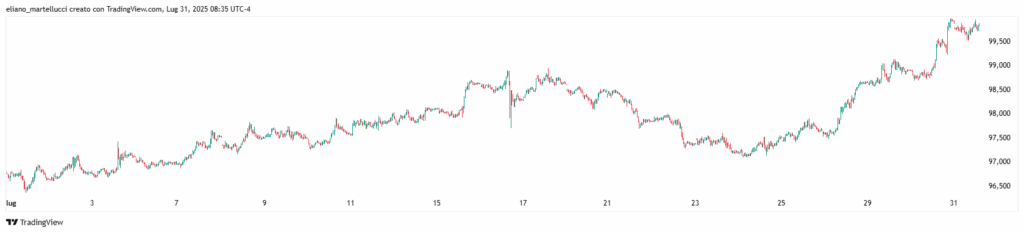

Although the trend of Bitcoin’s price tends to be inversely correlated with the Dollar Index only in the medium term, it has been almost a month now that the dollar has been strengthening without BTC reacting by going down.

Bitcoin: le notizie negative

The negative news for Bitcoin are two.

The first, as already highlighted, is the continuous rise of the Dollar Index (DXY), which first went from less than 97 points to more than 98 in the first half of the month, and now has also risen to almost 100 points.

The second, however, arrived yesterday, when the president of the Fed Jerome Powell in a press conference indicated that the probabilities of a rate cut in September have decreased.

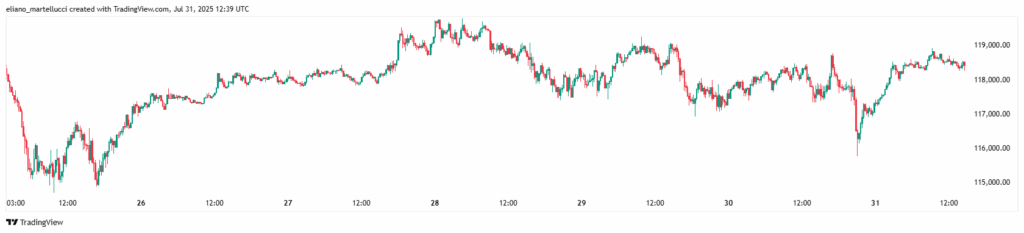

It is not a coincidence that yesterday the main US stock indices fell, while the price of BTC, after an initial drop, today returned to previous levels, completely nullifying yesterday’s decline.

It should however be added that, after the closure of the US stock exchanges, the futures on the US indices also rose, in line with what Bitcoin did.

The positive news that makes the price of BTC soar

There are also two positive news items.

The first is that the companies that are accumulating Bitcoin for their treasury, like Strategy by Michael Saylor, are continuing to buy BTC.

Therefore, an accumulation phase is underway that has been going on for several months now, despite the prices being very high, and they continue to remain so.

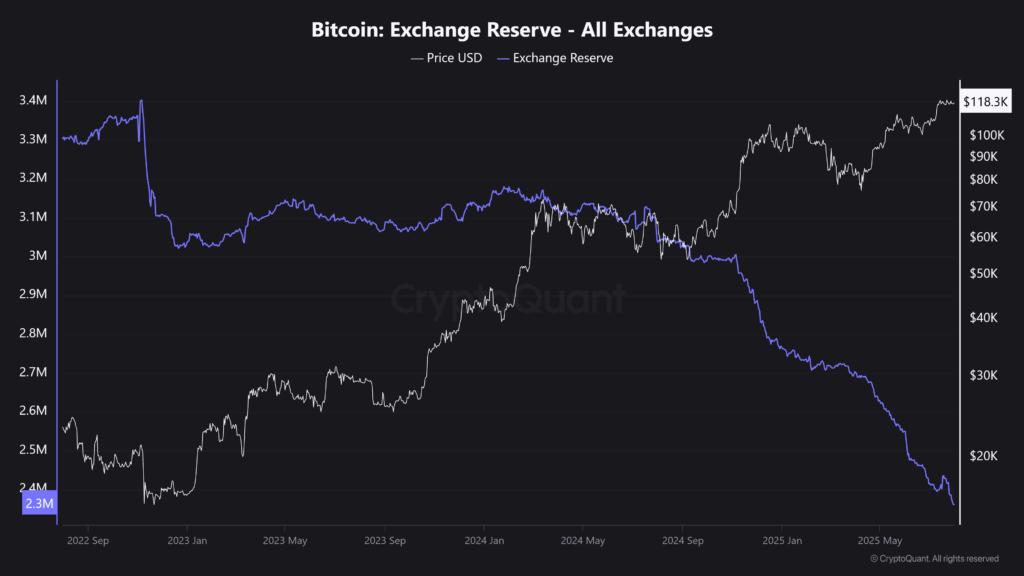

The second is that the selling pressure of BTC on crypto exchanges is continuing to decrease, although slightly. To all this, the level of Bitcoin reserves present on exchanges is currently at historic lows.

This is the real reason why the price of Bitcoin does not fall, despite the rise of the dollar, and it is closely linked to the accumulation phase mentioned above.

In other words, the selling pressure remains low, also because there is no fear in the crypto markets currently, while the buying pressure remains constant. The result is that the price of BTC does not fall, even though it could.

However, it should not be forgotten that fear and enthusiasm are emotions that come and go at the speed of light, and therefore the current situation of substantial absence of fear could also theoretically vanish in an instant.

The predictions on the price of Bitcoin (BTC)

In theory, there are many negative forecasts circulating that suggest a possible price correction of BTC.

However, they have been circulating for several days now, and so far they have proven to be incorrect.

Furthermore, they anticipate a contained correction, also because it could then be followed by a new bull phase.

Note that institutional net purchases of Bitcoin have just exceeded 97% of all transactions, and the last time something similar occurred was in August 2020, before the start of the last major bull run crypto.

Gli acquisti netti istituzionali hanno appena superato il 97% di tutte le transazioni. L’ultima volta che gli acquisti netti da parte dei professionisti sono stati così alti è stato ad agosto 2020. Chi sa, sa.

Indicatori alpha unici disponibili solo su https://t.co/4kg9n4hMnY. pic.twitter.com/7CYH5TNPU7

— Charles Edwards (@caprioleio) 31 luglio 2025

To this must be added that, just as the current rise of the dollar was expected, in theory, a new decline of the Dollar Index in the coming months would also be expected.

The USA

The key to everything still seems to be the USA.

In particular, yesterday, the new US government task force for cryptocurrencies published its first complete official report. At the end of the presentation, it was also revealed that the USA intends to proceed shortly with the real and concrete establishment of the strategic reserve in BTC.

Recently, the final approval of the new law on stablecoin in the USA had also pushed altcoins, so now it is expected that the adoption of cryptocurrencies in the United States will grow significantly, even if not in the short term.

In such a scenario, what happens in the USA could be decisive for the future trend of BTC price, even in the medium/short term.

The 2017

Finally, it should be highlighted that there are several parallels with 2017.

In particular, the BTC price candle of this July 2025 that is about to close looks very much like that of August 2017.

The year 2017 was the year following the first electoral victory of Trump and the second halving of Bitcoin (which occurred in 2016), and it was also the year of the second great speculative bubble in the crypto markets.

The first one occurred in 2013, that is, the year following Obama’s second electoral victory and the first halving (which took place in 2019), and the last one occurred in 2021, that is, the year following Biden’s electoral victory and the third halving (which took place in 2020).

Bitcoin was created in 2009, and the last halving occurred last year.

If history were to repeat itself as it did starting from August 2017, there could be a month of correction, noticeable but not particularly pronounced, followed by three months of bull run and then a bear-market of about 12 months.