Tonight at 8:00 PM UTC+1, the US FED will sit at the “Federal Open Market Committee” (FOMC) to establish the future direction of interest rates.

The analysts predict a “no change” situation that will leave no room for either increases or reductions in relation to the cost of money in the United States.

In such a context, the latest political moves by Trump on immigration in the country contribute to increasing the inflation of the dollar, raising the chances of a new stimulus for the monetary policies of the FED.

All these events spill over into the riskiest market like that of cryptocurrencies, which is currently in a phase of stagnation. What should we expect in the coming months?

Let’s see all the details below.

“no change” expected in the FED decision on a further interest rate cut

This evening the Federal Reserve (FED) will host its first meeting of the year, with Jerome Powell who will have to report the Committee’s decision regarding interest rates.

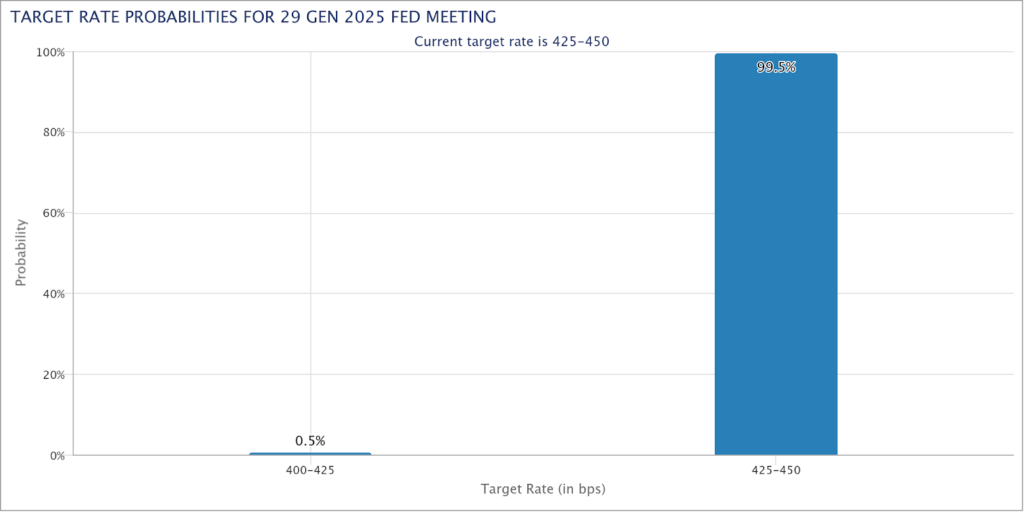

Most likely the current range, between 4.25% and 4.5%, will be confirmed, without allowing room for potential bull or bear maneuvers.

According to the FedWatch Tool of the CME Group, there is a 99.5% chance that the American central bank will go for a “no change” in rates.

This event follows the latest meeting of the FED in December, where alongside a 25 basis point cut, the intention to proceed more cautiously with the monetary policies of 2025 was noted.

Until then, there had been talk of at least 3 potential cuts during the course of the year, but then the trajectory was revisited due to the complex economic situation.

Obviously, this paradigm shift has had a negative effect on high-risk assets like Bitcoin, which now waver in uncertainty.

The experts agree that today’s FED meeting will be a “non-event”, as it will not trigger further turbulence on the speculative stock markets.

It was indeed quite expected that in January Powell and his team would not touch the interest rates, keeping the cost of money unchanged.

Already from last month, it was possible to sense that in January there would not be any particular changes, and the markets priced themselves accordingly in advance.

As reported by Danske Bank in a note to its clients:

“We doubt that this week’s FOMC meeting will be a major market factor, as the decision to keep the rate unchanged was well communicated in advance in December. The minutes revealed that participants have already made some preliminary assumptions about Trump’s policies, but given the considerable uncertainty, we doubt that Powell will feel comfortable providing the markets with strong guidance”.

Despite this, the possibility remains open that Powell, having to address several sharp topics in the press conference following the FOMC, may use words that could influence the markets positively or negatively.

The effect of Trump’s migration policies on the US economy and on the dollar’s inflation

One of the most heated topics to which the president of the FED will likely have to respond will be that of the new policies undertaken by Donald Trump.

Powell will probably be called upon to examine how Trump’s decision to expel illegal immigrants will affect the American economy.

To contextualize, a few days ago the new USA President initiated the deportation of a number between 1 and 10 million illegal immigrants to their respective home countries.

To this is added the introduction of heavy tariffs of 25% towards Mexico and Canada, with negative repercussions also for Europe.

Analysts predict that these policies could contribute to a rise in dollar inflation, creating a climate of uncertainty in the labor market.

As stated by Shantanu Khanna, associate professor of economics at Northeastern University, mass deportation could have disastrous effects.

The reason for this pessimistic view is that undocumented immigrants held underpaid jobs that native Americans tend to seek less, such as construction, childcare, and elder care.

These sectors are fundamental for the U.S. economy, and the lack of workforce in this context could lead to a strong halt in GDP.

In parallel, new regular workers will have to cover, albeit with difficulty, the gaps created by the departure of immigrants, with a consequent increase in non-farm payroll (non farm payroll).

In turn, like a cascading effect, higher paychecks will increase the amount of money in circulation, acting in an inflationary manner.

If Powell shared a similar perspective, it could dampen expectations of rate cuts, potentially even leading to a shift “towards the tightening easing“.

Regarding this complex situation, Benjamin Picton, Senior Macro Strategist at Rabobank, commented in a recent note as follows:

“The disappearance of up to 1 million potential workers from the U.S. workforce would not be a small thing. […] This is in itself inflationary, and this without considering the further impacts of tax cuts and tariffs”.

How Bitcoin and crypto react to the new FED stimuli

If the FED were to make a drastic decision to curb the risk of rising inflation, Bitcoin and crypto could react poorly.

This hypothesis seems nonetheless unlikely in an outlook like today’s, especially considering the past results of the Consumer Price Index (CPI).

In essence, there is not yet enough data to judge whether Trump’s policies will require a more stringent approach towards interest rates.

For the moment, inflation is under control, the labor market still seems stable and strong, and there are no major potential pitfalls for the economy.

It therefore remains unlikely that Powell will decide today to shake the fate of the markets, going to expose himself in one of the two directions expected by investors.

Rather, a response to the new macroeconomic dynamics could be released in the next FOMC on March 19, 2025.

On that date, there is greater confidence that the FED may implement the first rate cut of the year, albeit with some possible difficulty.

A rate cut to 400-425 basis points is priced at 30.2% while a further “no change” after the one expected for today is estimated at 69.6%.

Compared to the December quotations, it is less likely that there will be a cut, while the non-change in the cost of money becomes more credible.

The fate of Bitcoin in the coming weeks will partly depend on how the next monetary policy of the FED will be oriented and how Powell will interpret the current scenario.

At this moment, risk-on assets are in a stalemate position, driven by the general enthusiasm of the bull market but at the same time held back by macroeconomic tensions and new monetary concerns.

It will be essential to observe which direction the FED will take from now on, as it will also inevitably determine the future direction of the crypto markets.

In the meantime, let’s enjoy the “good afternoon” from Powell, which will be pronounced with a 97% probability according to Polymarket.