Good news for Tether, the company that manages the issuance of the USDT stablecoin, which is gaining more and more market share by confirming itself as the industry leader, except for the world of ERC-20 tokens where activity remains flat.

USDT’s market capitalization is approaching new all-time highs effectively undoing the losses incurred during the bear market, but at the same time it is possible to observe that on the Ethereum blockchain the supply of the stablecoin has remained unchanged for over a year: what is going on?

Let’s find out together in this article

Tether’s market capitalization heads for new all-time highs

Tether, the British Virgin Islands-based company that regulates and monitors the issuance of new USDT, is further strengthening its position in the stablecoin sector and preparing to set new records, but not in terms of the ERC-20 token market.

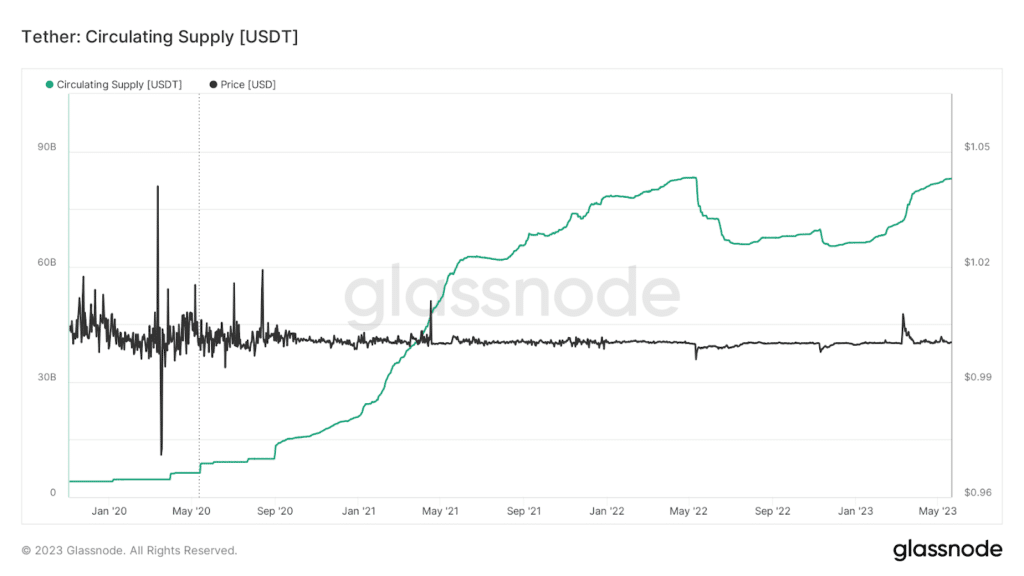

As of the beginning of 2023, in the midst of the US banking crisis that saw the bankruptcy of institutions such as Silicon Valley Bank, the supply of crypto USDT has risen from $66.2 billion to the current $82.9 billion, moving ever closer to the May 2022 ATH.

It is worth recalling that in the case of stablecoins, the circulating supply coincides with the market capitalization, provided that the token in question is priced at $1 and there are no ongoing depegs.

This means that in the case of 100% hedging with liquid assets (as is the case with Tether), the more stablecoins are minted and issued in the market, the more countervalue is stored in the issuing company.

Tether is approaching to record the highest supply ever which would suggest the possibility of a liquidity injection in the markets, but at the same time prices of most crypto assets remain low as well as trading volumes in USDT on centralized and non-centralized markets.

In this regard, USDT retains its hegemony only on CEXs such as Binance, Coinbase, Okx, and Bybit, but still plays a marginal role on DEXs in the DeFi world, with a market share of 20%, where the primacy of Circle and its USDC crypto reigns supreme.

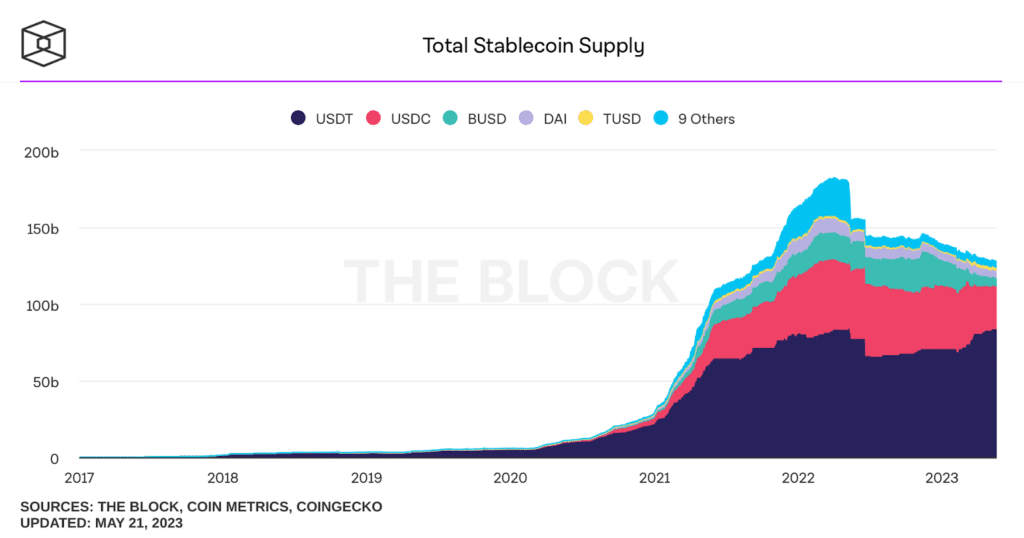

The other stablecoins currently competing with Tether are DAI, TUSD, and BUSD but collectively cover a capitalization of just over $12 billion, far behind the frontrunner.

BUSD could easily lose its remaining market share after the SEC ordered Paxos to stop issuing the stablecoin owned by Binance. in accordance with guidance and coordination with the New York Department of Financial Services (NYDFS).

Changpeng Zhao‘s exchange as a counter-response is pushing the TUSD stablecoin with trading fee discounts and promotions, most likely with the intent to replace BUSD which unfortunately has its days numbered.

Tether is not growing in the ERC-20 token world despite capitalization nearing new all-time highs

Despite the fact that Tether is flexing its muscles against its main competitors and is poised to record the highest market capitalization ever, in the case of the Ethereum blockchain and ERC-20 tokens, USDT supply has remained flat over the past year.

Overall, the trend remains positive as the other stablecoins such as USDC, BUSD, and DAI have lost a lot of supply on Ethereum since last year with a drain of nearly $32 billion.

In detail, as of May 2022, Teher’s supply stood at $36.82 billion while today it stands at $36.28 billion. Over the same period, if we look at all existing blockchains, USDT grew by $5 billion while the whole stablecoin sector lost $28 billion.

Viewing the data from this perspective, the fact that USDT on Ethereum has made little progress turns out to be less serious than one might have initially thought.

However, one question always remains: where did Tether’s growth take place if not with ERC-20?

As Tether is a company more focused on off-shore exchanges rather than using its product in DeFi environments, it seems more sensible that there isn’t as much interest on Ethereum as Circle is placing with USDC.

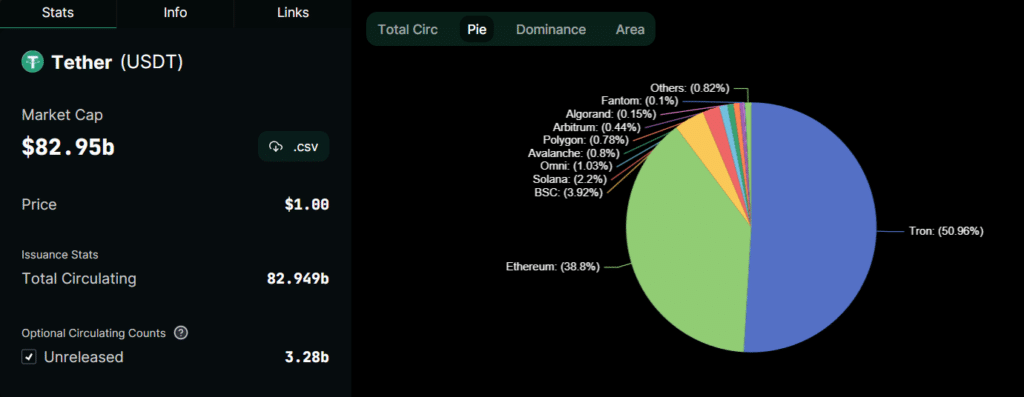

As such, the growth in supply, and consequently capitalization, has occurred on the Tron network where most USDT live, amounting to $42.3 billion.

Binance and Okx hold the largest USDT balances on Justin Sun’s blockchain, suggesting that whales and market makers prefer this network for its low fee costs.

Overall, Ethereum and Tron encompass about 90% of Tether’s supply, with the remaining 10% split between the BNB Chain, Solana, Omni, Avalanche, Polygon, Arbitrum, Algorand, and Fantom.

DeFi and stablecoin figures on Tron

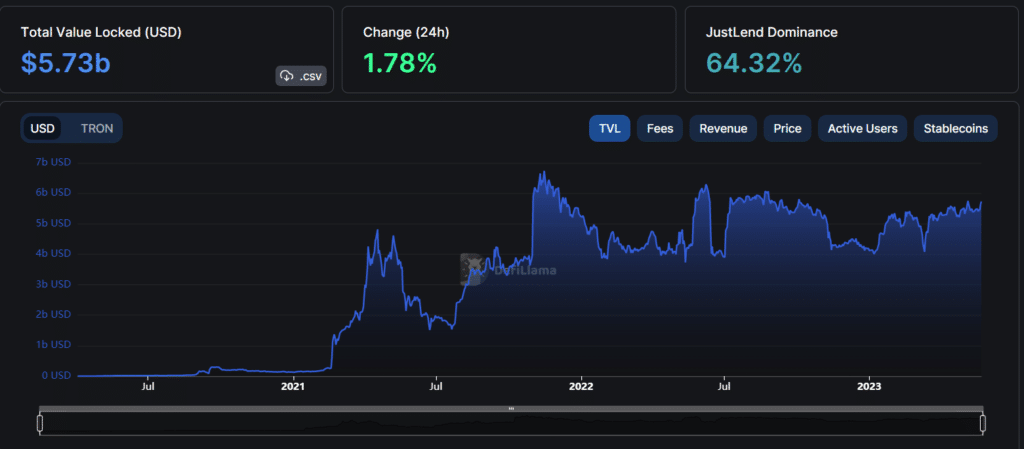

Although the Tron network is the favorite of large investors for off-shore exchanges, DeFi also registers significant numbers in the world by standing as the second largest blockchain for TVL (Total Value Locked) in decentralized protocols.

There is currently $5.73 billion spinning in Tron contracts, with values lower only than Ethereum’s, despite the fact that there are not a large number of projects developed on this network.

Indeed, in the first three protocols on Tron, namely JustLend, JustStables and Sun there is practically 99% of all the TVL in the chain.

The infrastructure of Justin Sun, founder of the Tron Foundation and the cryptocurrency exchange Huobi, works more than 64% on decentralized lending on the JustLend platform where assets such as USDT, USDC, TUSD,TRX, SUN, BTT and many more can be staked and borrowed.

The second platform for TVL is JustStables where the minting of Tron’s native stabelcoin, which is USDD with a marketcap of $736 million, takes place.

Stablecoins represent the main focus of this network, where there are no other interesting protocols to mention outside of those mentioned.

In fact, although Tron has a high TVL, it does not have much DeFi potential and is often underutilized, precisely because of the scarcity of projects within the ecosystem and the few opportunities it offers outside the crypto lending niche.

So why is so much capital flowing to Tron if it is such an underutilized blockchain (outside of the offshore market)?

The answer probably lies in its founder Justin Sun, who funds his network with his own capital, making it poorly decentralized.

It is enough to consider the fact that the first 3 protocols of the chain refer back to his name, which suggests delusions of grandeur on the part of the 30-year-old multibillionaire.

In support of this thesis we can see how since 2022, when the bear market began and capital started to flow out of crypto markets and the DeFi sector, the TVL on Tron has remained almost unchanged, probably precisely because the majority of the money inside belongs to its founder.

If this were not the case, such a situation where market makers reduce their risk on chains such as Ethereum while keeping their positions on Tron unchanged would be strange indeed.