Coming soon on the DeFi Aave protocol is the new GHO stablecoin.

In fact, within the DAO came the governance proposal to launch on the mainnet.

The idea had been launched in July last year, and by February the testnet had arrived.

If the governance proposal is approved by the DAO, the new stablecoin will also launch on the mainnet.

The launch of GHO on Aave V3

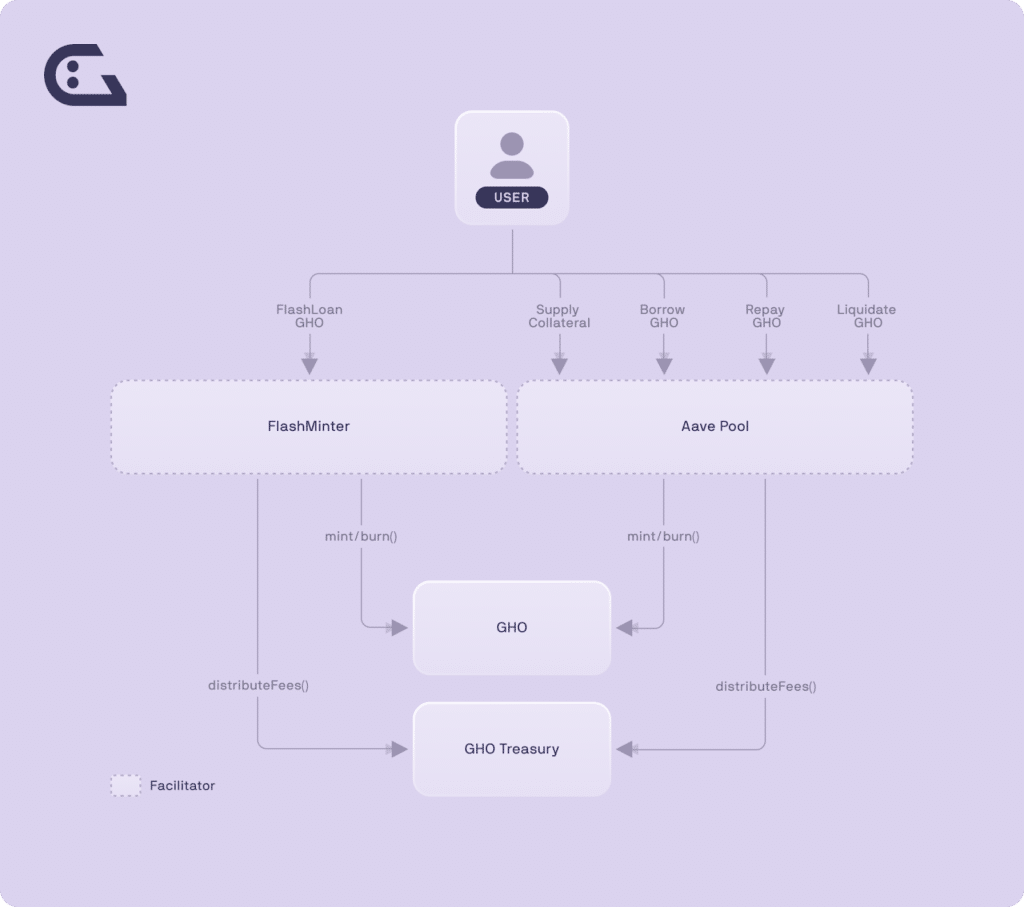

Initially GHO will arrive on Aave V3 Ethereum Facilitator and FlashMinter Facilitator, but later it should also land on the Ethereum mainnet.

CoinMarketCap has already published the tab for the new stablecoin, although it is still virtually empty for now.

They have been testing its performance on the Goerli testnet for months now, and now the time has come to release it publicly.

When it is launched on the mainnet, users of Aave V3 on Ethereum will be able to mint GHO tokens by giving the necessary guarantees in return. According to the creators, this will usher in a new era for the Aave ecosystem and related DAO.

At present, the exact timing is not yet known, partly because the governance proposal has not yet been finally approved.

What is GHO and how will it work?

GHO is a decentralized multi-collateral algorithmic stablecoin, native to the Aave protocol.

For its part, Aave is one of the main DeFi protocols on Ethereum, specializing in lending.

It ranks third overall for TVL right now, behind only Lido and Maker, but tailed by Curve and Uniswap.

It has been around since 2020 and at its peak even reached over $19 billion in TVL. Now it is about 5.

GHO is a token that will be minted initially only from assets supplied to the Aave protocol, and its market value will be programmatically aligned with that of the US dollar due to market efficiency.

As with all lending on Aave, users minting GHO will have to provide collateral at a specific ratio, and when they repay GHO borrowed in this way it will be returned to the Aave pool and burned.

All interest earned on GHO will go directly to the Aave DAO treasury.

It will effectively be the direct challenger to DAI, Maker’s algorithmic stablecoin.

Aave and the choice of launching GHO

Until now Aave did not have its own stablecoin, so externally created stablecoins had to be used within its DeFi protocol.

Right now, the most widely used stablecoins on Aave are USDT, USDC, and precisely DAI.

Due to the launch of GHO it is possible that DAI will lose some users, and perhaps Aave could end up overtaking Maker in the ranking of DeFi protocols with higher TVL.

However, the news of GHO’s launch does not seem to have had a significant impact on the price of the project’s native token, AAVE.

In fact, although the price is up from yesterday, it is still significantly below its 2023 highs.

By late 2022 it had plummeted below $53, after having been as high as $667 in May 2021.

During the early part of 2023 it had risen as high as $92, but only to retrace to below $59 a couple of days ago.

Today it seems relatively stable around $61.

It is worth mentioning that the current price is lower than the launch price, as the initial price in 2020 was around $70.

The role of algorithmic stablecoins

Algorithmic stablecoins are collateralized, but not in what they are pegged to.

That is, if they are pegged to the US dollar, they are not collateralized in US dollars. They are typically collateralized in other cryptocurrencies that are often quite volatile in value, so they have a higher degree of risk.

For example, UST of the Terra ecosystem was pegged to the US dollar but collateralized in LUNA, and when the market value of LUNA started to collapse, the stablecoin imploded.

GHO will be over-collateralized in different currencies, drawing inspiration from DAI. If the over-collateralization is sufficient, it should not lose the peg with the dollar even in the case of large fluctuations in the price of the collateral.

For example, DAI did not lose the peg when the price of Ethereum fell from $4,800 to $1,000.

Algorithmic stablecoins are the only ones that can be decentralized because they allow decentralized custody of the collateral.

Those collateralized in dollars, on the other hand, cannot be decentralized because the custodian of the dollars can only be a centralized entity.

(@lemiscate)

(@lemiscate)